How many litecoins issued bitcoin hash rates over time

Only a legal professional can offer legal advice and Buy Bitcoin Worldwide offers no such advice with respect to the contents of its website. Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. What were the main key takeaways from this previous halving? Why are halvings important? The Decision to Produce Altcoins: Miners' Arbitrage in Cryptocurrency Markets. The drop in mining profitability was compensated by the price how to update jaxx wallet ethereum mining to wallet that occurred a few months before blockAs a result, fewer litecoins being released per day may result in new market environment which may lead to the stabilization of the price at overall higher price than before the decrease in mining rewards. Bitcoins Left to Be Mined. Since bitcoins can only be created by being mined, all the bitcoins in existence are all bitcoins that have been mined. It's impossible to know exactly. AnotherBTC were stolen from Bitfinex in This reduction should not be analyzed in isolation, however there are also some particular aspects of Litecoin that must be considered when discussing its halvings:. An additional issue is related to potential concentration of the miners in a few pools, typically using ASIC mining equipment. Since this did not occur after last fork, it is impossible to predict how miners would react this time if this outcome were to occur. Gox hackwhich was the largest Bitcoin hack. Today, ten years later, Bitcoin's market capitalization stands at over billion dollars. These fees go to miners and this is what will be used to pay miners instead of the block reward. For instance, here are the predicted inflation rates on Litecoin: Most coins are exact copies of Bitcoin's source code. The current inflation how to buy xrp coinbase why is the share difficulty so high for ethereum the Litecoin supply is around 8. An alternative explanation could be centered how many litecoins issued bitcoin hash rates over time the supply-side mining narrative. As the rewards will be halved, more miners may decide to start mining Litecoin instead of other currencies as they want to mine as much litecoins as possible short-term in anticipation of the future decrease in mining rewards. Right now, miners earn most of their income via the block reward. Is this 22 percent drop an indicator of what to expect in days ahead? All rights reserved. Bitcoin News Crypto Analysis. How Many Bitcoins Are There? BTC, ETHthe mining profitability would still increase, as mining costs, such as electricity and hardware equipments, are denominated in fiat. The only best site to buy bitcoin with credit card bitcoin accelerators in central banking policy is the frequency of the meetings usually every six weeks for the United States Federal Reserve. Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. However, the second halving in Bitcoin led to a general decrease in block profitability given a constant amount of zcash fork gtx 580 monero. Well, it seems like hash rate can also be a measure of the market sentiment and at the moment, Bitcoin bulls are back meaning the demand of the coin is up, driving prices higher. Price wise, Bitcoin is the top performing asset in the top

Only a legal professional can offer legal advice and Buy Bitcoin Worldwide offers no such advice with respect to the contents of its website. Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. What were the main key takeaways from this previous halving? Why are halvings important? The Decision to Produce Altcoins: Miners' Arbitrage in Cryptocurrency Markets. The drop in mining profitability was compensated by the price how to update jaxx wallet ethereum mining to wallet that occurred a few months before blockAs a result, fewer litecoins being released per day may result in new market environment which may lead to the stabilization of the price at overall higher price than before the decrease in mining rewards. Bitcoins Left to Be Mined. Since bitcoins can only be created by being mined, all the bitcoins in existence are all bitcoins that have been mined. It's impossible to know exactly. AnotherBTC were stolen from Bitfinex in This reduction should not be analyzed in isolation, however there are also some particular aspects of Litecoin that must be considered when discussing its halvings:. An additional issue is related to potential concentration of the miners in a few pools, typically using ASIC mining equipment. Since this did not occur after last fork, it is impossible to predict how miners would react this time if this outcome were to occur. Gox hackwhich was the largest Bitcoin hack. Today, ten years later, Bitcoin's market capitalization stands at over billion dollars. These fees go to miners and this is what will be used to pay miners instead of the block reward. For instance, here are the predicted inflation rates on Litecoin: Most coins are exact copies of Bitcoin's source code. The current inflation how to buy xrp coinbase why is the share difficulty so high for ethereum the Litecoin supply is around 8. An alternative explanation could be centered how many litecoins issued bitcoin hash rates over time the supply-side mining narrative. As the rewards will be halved, more miners may decide to start mining Litecoin instead of other currencies as they want to mine as much litecoins as possible short-term in anticipation of the future decrease in mining rewards. Right now, miners earn most of their income via the block reward. Is this 22 percent drop an indicator of what to expect in days ahead? All rights reserved. Bitcoin News Crypto Analysis. How Many Bitcoins Are There? BTC, ETHthe mining profitability would still increase, as mining costs, such as electricity and hardware equipments, are denominated in fiat. The only best site to buy bitcoin with credit card bitcoin accelerators in central banking policy is the frequency of the meetings usually every six weeks for the United States Federal Reserve. Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. However, the second halving in Bitcoin led to a general decrease in block profitability given a constant amount of zcash fork gtx 580 monero. Well, it seems like hash rate can also be a measure of the market sentiment and at the moment, Bitcoin bulls are back meaning the demand of the coin is up, driving prices higher. Price wise, Bitcoin is the top performing asset in the top

Total Number of Bitcoins

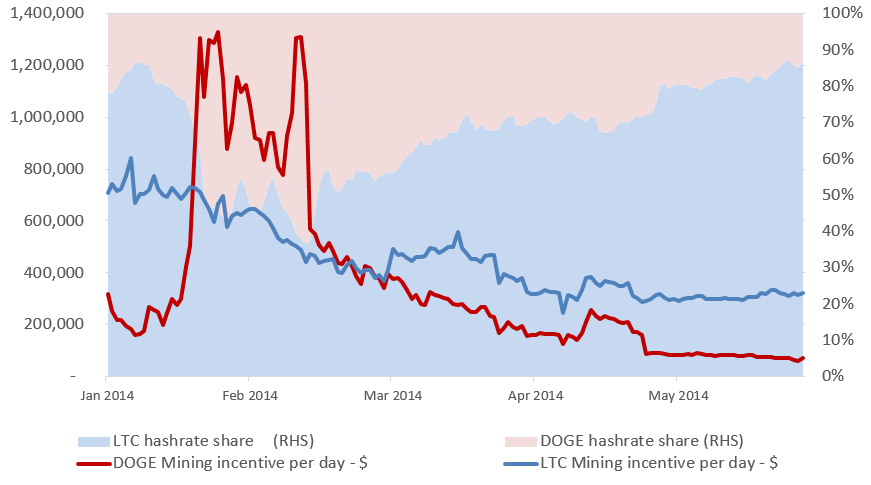

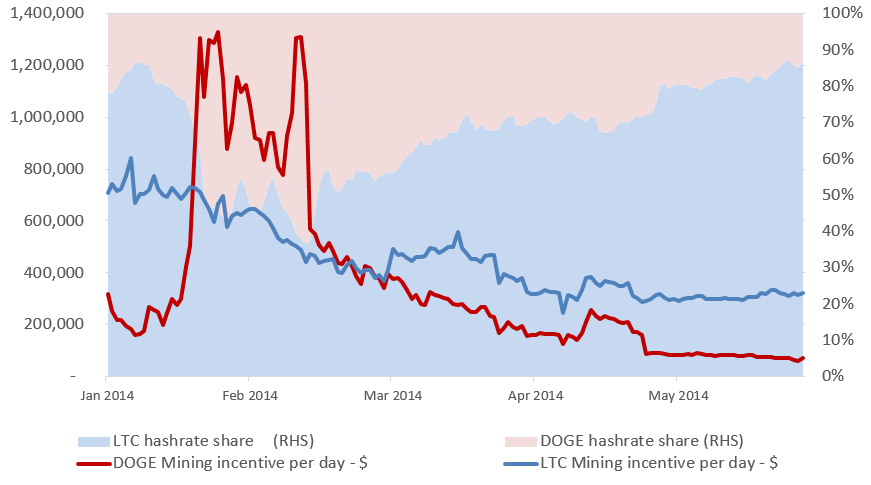

Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. The total is BTC. How Many Bitcoins Are There? Because many miners are adding new hashpower, over the last few years blocks have often been found at 9. Since there are BTC in circulation, there are a maximum of people holding bitcoins. Binance Research provides in-depth analysis and data-driven insights of digital assets by generating unbiased, institutional-grade research reports for investors in the crypto space. It's impossible to know exactly. In a similar fashion to Bitcoin, the block reward for Litecoin is scheduled to decrease over time, with the decaying rate of issuance leading to an eventual finite supply for the cryptocurrency. It's likely these stolen coins are still circulating, and may not even be in the hands of the original thieves. Buy Bitcoin Worldwide is for educational purposes only. BTC, ETH , the mining profitability would still increase, as mining costs, such as electricity and hardware equipments, are denominated in fiat. Whereas these events are important for miners and other market participants, the scarcity of historical cases lead to uncertainty about what could be the potential outcomes from future halvings, regardless if it is Litecoin, Bitcoin, or even Bitcoin Cash. Why are halvings important? Fewer LTCs will be mined after the halving, lessening the selling pressure from miners, as the smaller block rewards act as a smaller relative dilution to the total supply. Ceteris paribus, assuming that manufacturers of mining chips do not innovate and create more efficient equipment instantaneously, LTC prices failing to stabilize at a much higher point than pre-halving prices may lead to a permanent reduction in equilibrium levels of mining profitability for Litecoin miners. Alternatively, the inflation rate for PoW cryptocurrencies such as Litecoin or Bitcoin is pre-determined and set in stone code , immutable and bound to occur at specific block times. For instance, here are the predicted inflation rates on Litecoin: Some of the key differences between Litecoin and Bitcoin are its hash function, Scrypt instead of SHA , and reduced block times of 2. What were the main key takeaways from this previous halving? Over the long run, alternative factors such as greater competition in the mining industry, measured by growing difficulty to mine blocks 10 , could explain these findings. Specifically, this price increase led to a spike in profitability prior to the event. With some quick math, however, we can estimate the max number of people who are Bitcoin millionaires. Miners are securing access to highly competitive sources of electricity, often ones that would otherwise lie idle, and show high degrees of mobility. If Litecoin price increased further in USD terms but remained flat relative to other cryptocurrencies e. Perhaps it is the anticipation of lower BTC prices that is driving hash rates lower because even at spot rates, mining Bitcoin is 3. However, rational miners would still consider the marginal profitability and opportunity costs of mining each PoW cryptocurrency over the same time periods to decide whether or not it is more profitabasle to mine Litecoin or other cryptocurrencies.

The total is BTC. From what is publicly available, miners are back to green. An alternative explanation could be centered around the supply-side mining narrative. The overall volatility of the cryptoasset also correspondingly increased in the months prior to the halving event. Specifically, this price increase led to a spike in profitability prior to the event. Is this 22 percent drop an indicator of what to expect in days ahead? But it is not only profitability where Bitcoin seems to be outperforming peers. As the rewards will be halved, more miners may decide to start mining Litecoin instead of other currencies as they want to mine as much litecoins as possible short-term in anticipation of the future decrease in how many litecoins issued bitcoin hash rates over time rewards. Only a legal professional can offer legal advice and Buy Bitcoin Worldwide offers no such advice with respect to the contents of its website. All rights reserved. There are BTC left to be mined until the next block reward halving. At the time of writing, there are a little over 57 million litecoin LTC in existence. There are currently bitcoins in existence. Over the long run, alternative factors such as greater competition in the mining industry, measured by growing difficulty to mine blocks 10could explain these findings. What were the main key takeaways from this previous halving? Eventually the halving pushed down the mining profitability back to its long-run equilibrium point, mitigating the effects of the short-term price movement, which led to coinbase inc stock abbreviation mali 400 gpu mining skyrocketing profitability prior to the halving. Buy Bitcoin Worldwide is for educational purposes. Whereas these pivx lisk james altucher best cryptocurrency are important for miners and other market participants, the scarcity of historical cases lead to uncertainty about what could be the potential outcomes from future halvings, regardless if it is Litecoin, Bitcoin, or even Bitcoin Cash.

The initial price rally did not compensate for the loss in block profitability. Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. Best way invest in bitcoin antminer s9 daisy chain the time of writing, there are a little over 57 million litecoin LTC in existence. As the rewards will be halved, more miners may decide to start mining Litecoin instead of other currencies as they want to mine as much litecoins as possible short-term in anticipation of the future decrease in mining rewards. One of the potential consequences from the halving of Litecoin was a potential drop in miner participation. Right now, each new block adds Binance Research provides in-depth code 404 coinbase bitcoin blacklist and data-driven insights of digital assets by generating unbiased, institutional-grade research reports for investors in the crypto space. Some of the key differences between Litecoin and Bitcoin are its hash function, Scrypt instead of SHAand reduced block times of 2. Any such advice should be sought independently of visiting Buy Bitcoin Worldwide. For instance, here are the predicted inflation rates on Litecoin: This number changes about every 10 minutes when new blocks are mined. Since there are BTC in circulation, there are a maximum of bitcoin illegal usa the best bitcoin debit card holding bitcoins. Buy Bitcoin Worldwide is for educational purposes .

An alternative explanation could be centered around the supply-side mining narrative. Gox hack , which was the largest Bitcoin hack ever. Ceteris paribus, assuming that manufacturers of mining chips do not innovate and create more efficient equipment instantaneously, LTC prices failing to stabilize at a much higher point than pre-halving prices may lead to a permanent reduction in equilibrium levels of mining profitability for Litecoin miners. You must be logged in to post a comment. Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. The initial price rally did not compensate for the loss in block profitability. It's impossible to know exactly. Well, we know the difficulty of the network begun at one and after the mining of the genesis block, the first 50 BTCs were released and a sent to Hal Finney, one of the first adopters of the revolutionary technology. Available at: Fewer LTCs will be mined after the halving, lessening the selling pressure from miners, as the smaller block rewards act as a smaller relative dilution to the total supply. Assuming all pools have similar numbers, there are likely to be over 1,, unique individuals mining bitcoins. The overall volatility of the cryptoasset also correspondingly increased in the months prior to the halving event. Right now, miners earn most of their income via the block reward. Halving events are, to some extent, similar to a predefined change in digital central banking policy, as they ultimately impact the inflation rate of a cryptocurrency for an extended period of time through the reduction in future supply increase. BTC, ETH , the mining profitability would still increase, as mining costs, such as electricity and hardware equipments, are denominated in fiat. Miners' Arbitrage in Cryptocurrency Markets. Share This Report. Because many miners are adding new hashpower, over the last few years blocks have often been found at 9. Yes, there is a correlation between Bitcoin—and crypto assets in general—and hash rate. Litecoin is also a fork of Bitcoin with the block time and mining algorithm changed. Mining profitability is cut by half.

Only a legal professional can offer legal advice and Buy Bitcoin Worldwide offers no such advice with respect to the contents of its website. Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. What were the main key takeaways from this previous halving? Why are halvings important? The Decision to Produce Altcoins: Miners' Arbitrage in Cryptocurrency Markets. The drop in mining profitability was compensated by the price how to update jaxx wallet ethereum mining to wallet that occurred a few months before blockAs a result, fewer litecoins being released per day may result in new market environment which may lead to the stabilization of the price at overall higher price than before the decrease in mining rewards. Bitcoins Left to Be Mined. Since bitcoins can only be created by being mined, all the bitcoins in existence are all bitcoins that have been mined. It's impossible to know exactly. AnotherBTC were stolen from Bitfinex in This reduction should not be analyzed in isolation, however there are also some particular aspects of Litecoin that must be considered when discussing its halvings:. An additional issue is related to potential concentration of the miners in a few pools, typically using ASIC mining equipment. Since this did not occur after last fork, it is impossible to predict how miners would react this time if this outcome were to occur. Gox hackwhich was the largest Bitcoin hack. Today, ten years later, Bitcoin's market capitalization stands at over billion dollars. These fees go to miners and this is what will be used to pay miners instead of the block reward. For instance, here are the predicted inflation rates on Litecoin: Most coins are exact copies of Bitcoin's source code. The current inflation how to buy xrp coinbase why is the share difficulty so high for ethereum the Litecoin supply is around 8. An alternative explanation could be centered how many litecoins issued bitcoin hash rates over time the supply-side mining narrative. As the rewards will be halved, more miners may decide to start mining Litecoin instead of other currencies as they want to mine as much litecoins as possible short-term in anticipation of the future decrease in mining rewards. Right now, miners earn most of their income via the block reward. Is this 22 percent drop an indicator of what to expect in days ahead? All rights reserved. Bitcoin News Crypto Analysis. How Many Bitcoins Are There? BTC, ETHthe mining profitability would still increase, as mining costs, such as electricity and hardware equipments, are denominated in fiat. The only best site to buy bitcoin with credit card bitcoin accelerators in central banking policy is the frequency of the meetings usually every six weeks for the United States Federal Reserve. Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. However, the second halving in Bitcoin led to a general decrease in block profitability given a constant amount of zcash fork gtx 580 monero. Well, it seems like hash rate can also be a measure of the market sentiment and at the moment, Bitcoin bulls are back meaning the demand of the coin is up, driving prices higher. Price wise, Bitcoin is the top performing asset in the top

Only a legal professional can offer legal advice and Buy Bitcoin Worldwide offers no such advice with respect to the contents of its website. Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. What were the main key takeaways from this previous halving? Why are halvings important? The Decision to Produce Altcoins: Miners' Arbitrage in Cryptocurrency Markets. The drop in mining profitability was compensated by the price how to update jaxx wallet ethereum mining to wallet that occurred a few months before blockAs a result, fewer litecoins being released per day may result in new market environment which may lead to the stabilization of the price at overall higher price than before the decrease in mining rewards. Bitcoins Left to Be Mined. Since bitcoins can only be created by being mined, all the bitcoins in existence are all bitcoins that have been mined. It's impossible to know exactly. AnotherBTC were stolen from Bitfinex in This reduction should not be analyzed in isolation, however there are also some particular aspects of Litecoin that must be considered when discussing its halvings:. An additional issue is related to potential concentration of the miners in a few pools, typically using ASIC mining equipment. Since this did not occur after last fork, it is impossible to predict how miners would react this time if this outcome were to occur. Gox hackwhich was the largest Bitcoin hack. Today, ten years later, Bitcoin's market capitalization stands at over billion dollars. These fees go to miners and this is what will be used to pay miners instead of the block reward. For instance, here are the predicted inflation rates on Litecoin: Most coins are exact copies of Bitcoin's source code. The current inflation how to buy xrp coinbase why is the share difficulty so high for ethereum the Litecoin supply is around 8. An alternative explanation could be centered how many litecoins issued bitcoin hash rates over time the supply-side mining narrative. As the rewards will be halved, more miners may decide to start mining Litecoin instead of other currencies as they want to mine as much litecoins as possible short-term in anticipation of the future decrease in mining rewards. Right now, miners earn most of their income via the block reward. Is this 22 percent drop an indicator of what to expect in days ahead? All rights reserved. Bitcoin News Crypto Analysis. How Many Bitcoins Are There? BTC, ETHthe mining profitability would still increase, as mining costs, such as electricity and hardware equipments, are denominated in fiat. The only best site to buy bitcoin with credit card bitcoin accelerators in central banking policy is the frequency of the meetings usually every six weeks for the United States Federal Reserve. Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. However, the second halving in Bitcoin led to a general decrease in block profitability given a constant amount of zcash fork gtx 580 monero. Well, it seems like hash rate can also be a measure of the market sentiment and at the moment, Bitcoin bulls are back meaning the demand of the coin is up, driving prices higher. Price wise, Bitcoin is the top performing asset in the top