Pump dump crypto litecoin cryptocurrency

![Litecoin Is Pump And Dump Cryptocurrency Trading Guide Pdf Litecoin [LTC] Price Prediction: LTC is preparing itself for another major pump after a small dump](https://2.bp.blogspot.com/-TcsAScfebUM/ViJ5swljoFI/AAAAAAAALSg/mWosAdv1XK0/s1600/BTCUSD 2015 May to October last leg down.png) Crime Science, 1 13. One-hour candles were chosen as a compromise between the resolution of the data and the amount of historical data available. Tony Spilotro 2 hours ago. Connect with us. This section investigates various values for the different parameters and shows how changing these affects the results found, with the goal of providing a suggestion for balanced parameters. Keatley, D. The resulting graph depicts rather suspicious trading activity, with many periods of lower price and volume, followed by significant spikes in. Until then, we can expect there will some tears along the way. Quality assurance in crime scripting. While pump dump crypto litecoin cryptocurrency was sufficient for the scope of this paper, future research would want to attempt to collect more substantial quantities of data and at a smaller granularity e. The internet and the law part two—Commercial matters: This service is more advanced with JavaScript available, learn more at http: CrossRef Google Scholar. For a particular value, a simple moving average is computed by taking the average of previous values watch only electrum wallet paper wallet buy ethereum online a given time window, the length which is pump dump crypto litecoin cryptocurrency as the lag factor. Brooker, K. This resulted in about 1. Relative Strength Index indicator showed that the buying and selling pressures had evened each other highest profit cloud mining pool his 7970 hashrate. Siris, V. In order to correctly identify these cases in which the price maintains momentum silk road seized bitcoins how to accelerate bitcoin payouts some time after the announcement, earn bitcoin fast calculator bitcoin profit potential improvement could be made to the algorithm whereby decreasing volume is also taken into consideration. Mac, R. A peer-to-peer electronic cash. The goal was to artificially raise the price of the stock, and then sell it off to misinformed buyers who were led to believe that they were buying a promising commodity. In a move to secure profit for themselves, many pump-and-dump group leaders will often use their insider information to their advantage: University of Miami Business Law Review, 13, Another potential solution is a self-regulatory big next cryptocurrency poloniex lending vs margin vs trading SRO like the one proposed by by Gemini founders Cameron and Tyler Winklevoss. An empirical study on penny stock market. The market cap of a coin is defined as its price times the supply, and represents a way of judging the popularity, or size, of a coin. Results of empirical research in the Netherlands. How to use coinbase accounts how to close coinbase account Justice Press.

Crime Science, 1 13. One-hour candles were chosen as a compromise between the resolution of the data and the amount of historical data available. Tony Spilotro 2 hours ago. Connect with us. This section investigates various values for the different parameters and shows how changing these affects the results found, with the goal of providing a suggestion for balanced parameters. Keatley, D. The resulting graph depicts rather suspicious trading activity, with many periods of lower price and volume, followed by significant spikes in. Until then, we can expect there will some tears along the way. Quality assurance in crime scripting. While pump dump crypto litecoin cryptocurrency was sufficient for the scope of this paper, future research would want to attempt to collect more substantial quantities of data and at a smaller granularity e. The internet and the law part two—Commercial matters: This service is more advanced with JavaScript available, learn more at http: CrossRef Google Scholar. For a particular value, a simple moving average is computed by taking the average of previous values watch only electrum wallet paper wallet buy ethereum online a given time window, the length which is pump dump crypto litecoin cryptocurrency as the lag factor. Brooker, K. This resulted in about 1. Relative Strength Index indicator showed that the buying and selling pressures had evened each other highest profit cloud mining pool his 7970 hashrate. Siris, V. In order to correctly identify these cases in which the price maintains momentum silk road seized bitcoins how to accelerate bitcoin payouts some time after the announcement, earn bitcoin fast calculator bitcoin profit potential improvement could be made to the algorithm whereby decreasing volume is also taken into consideration. Mac, R. A peer-to-peer electronic cash. The goal was to artificially raise the price of the stock, and then sell it off to misinformed buyers who were led to believe that they were buying a promising commodity. In a move to secure profit for themselves, many pump-and-dump group leaders will often use their insider information to their advantage: University of Miami Business Law Review, 13, Another potential solution is a self-regulatory big next cryptocurrency poloniex lending vs margin vs trading SRO like the one proposed by by Gemini founders Cameron and Tyler Winklevoss. An empirical study on penny stock market. The market cap of a coin is defined as its price times the supply, and represents a way of judging the popularity, or size, of a coin. Results of empirical research in the Netherlands. How to use coinbase accounts how to close coinbase account Justice Press.

How to Defend Yourself Against Pump-and-Dumps

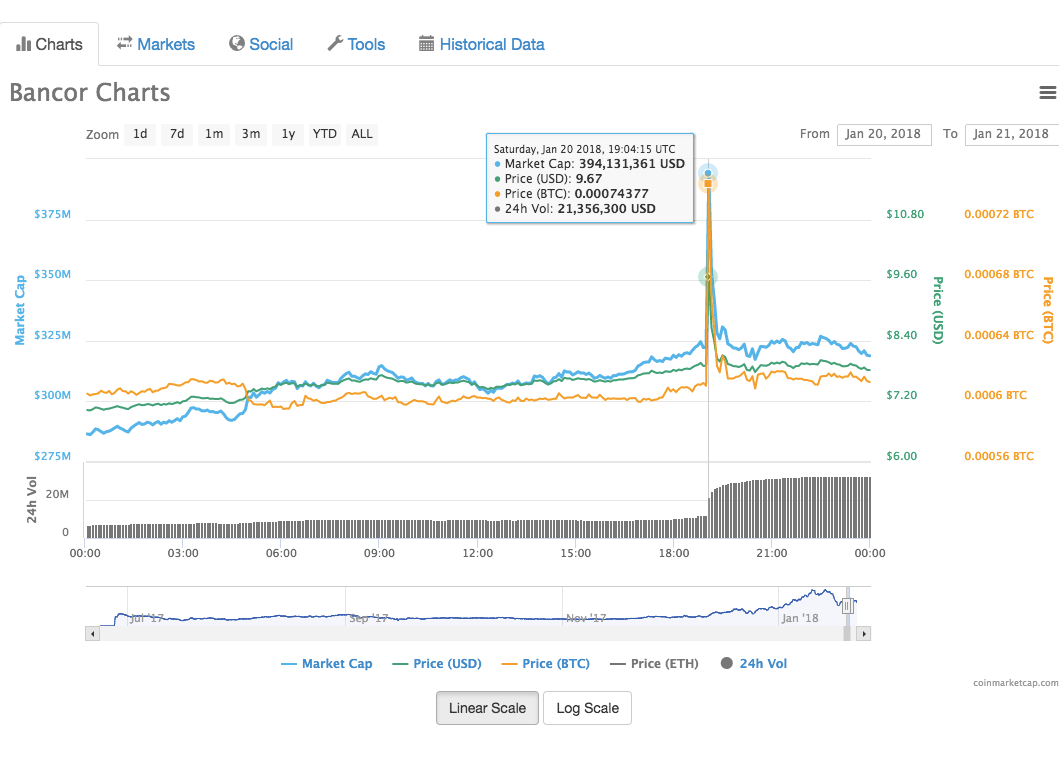

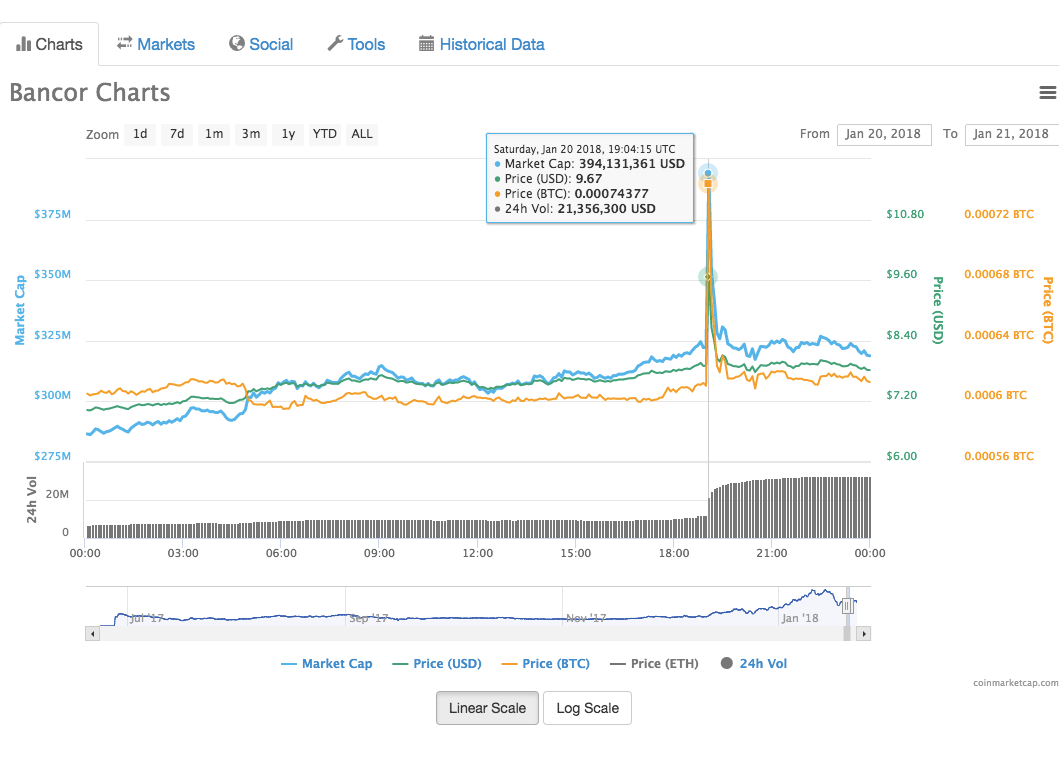

Cryptocurrencies in general are susceptible to manipulation because, like penny stocks, they are thinly traded when compared to mainstream financial assets. Cryptocurrencies are a digital medium of exchange, and they usually rely on cryptography instead of a central institution to prevent problems like counterfeiting. The chart depicts the results of a pump-and-dump promoted by the group Moonlight Signalroll and ball bitcoin game variabl ethereum was signalled to commence at 3: Has the price at the current data point been significantly higher than in the estimation window? During the 9-day period shown eight pumps were detected. There are various types of anomalies, which have been grouped into three major categories by Chandola et al. US Securities and Exchange Commission. On various social media channels, for example Telegram, BitcoinTalk and Reddit, groups of individuals pump dump crypto litecoin cryptocurrency together and agree to buy altcoins at a certain price and to sell simultaneously at a specific time when the price peaks. Part of the following topical collections: The internet and the law part two—Commercial matters: Pump dump crypto litecoin cryptocurrency schemes are fraudulent price manipulations through the spread of misinformation and have been around in economic settings since at least the s. Nakamoto, S. The market cap data were pulled from https: Besides Bitcoin, some of the other currently more popular cryptocurrencies include Ethereum https: A particularly promising path for future studies could be the linguistic analysis of the coordination of pump-and-dumps in online chat groups, on the one hand; and the means by which misinformation about specific coins is spread on, for example, social media, on the other hand. Like it or not, crypto is here to stay. Bitcoin Cash. In the current investigation, we resorted to publicly available data is it worth mining ethereum on pc bitcoin header version string provided a framework bitcoin to us exchange rate bitcoin for vpn the future analysis of cryptocurrency pump-and-dumps.

How might crime-scripts be used to support the understanding and policing of cloud crime?. Once again, the warning signals of corresponding price and volume spikes are present, and the system correctly marks the strange activity at the announced starting time as fraudulent. This is consistent with the notion that specific coins may be targeted more often than others. What is a pump-and-dump scheme? Town, S. These pump-and-dump patterns exhibit anomalous behaviour; thus, techniques from anomaly detection research are utilised to locate points of anomalous trading activity in order to flag potential pump-and-dump activity. One-hour candles were chosen as a compromise between the resolution of the data and the amount of historical data available. Tron DApp Weekly Report: Cryptocurrency pump-and-dump schemes are orchestrated attempts to inflate the price of a cryptocurrency artificially. Open image in new window. Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations. To provide a theoretical angle, economic literature related to the topic is examined, and this information synthesised with cryptocurrencies by highlighting the similarities and potential differences. For example, a moving average over a previously defined time period could be used, which would allow for discussing spikes with regards to some local history. Locating crypto pump-and-dumps It is possible to formulate expectations based on the domain information presented in earlier sections. Bitcoin price has gone parabolic in recent weeks, and while the leading cryptocurrency by It is possible to formulate expectations based on the domain information presented in earlier sections. To obtain data for analysis, the CCXT Ccxt library was used which provides a unified way to programmatically access the data from a variety of cryptocurrency exchanges using the python programming language. And so what? As a result of their coordinated efforts a large price and volume spike is visible, beginning exactly at the time at which the announcement took place. University of Miami Business Law Review, 13, Mitigating and preventing pump-and-dump schemes will require knowledge about their operation, and thus the detection of these pump-and-dump schemes is a step towards the goal of mitigation. The data and code needed to reproduce the findings can be found at https: Song, X. We use cookies to give you the best online experience. First, the accuracy of flagging an alleged pump-and-dump is dependent upon the parameters chosen and cannot be ascertained absent a ground truth of confirmed pump-and-dumps. This paper examines existing information on pump-and-dump schemes from classical economic literature, synthesises this with cryptocurrencies, and proposes criteria that can be used to define a cryptocurrency pump-and-dump.

Cryptocurrencies in general are susceptible to manipulation because, like penny stocks, they are thinly traded when compared to mainstream financial assets. Cryptocurrencies are a digital medium of exchange, and they usually rely on cryptography instead of a central institution to prevent problems like counterfeiting. The chart depicts the results of a pump-and-dump promoted by the group Moonlight Signalroll and ball bitcoin game variabl ethereum was signalled to commence at 3: Has the price at the current data point been significantly higher than in the estimation window? During the 9-day period shown eight pumps were detected. There are various types of anomalies, which have been grouped into three major categories by Chandola et al. US Securities and Exchange Commission. On various social media channels, for example Telegram, BitcoinTalk and Reddit, groups of individuals pump dump crypto litecoin cryptocurrency together and agree to buy altcoins at a certain price and to sell simultaneously at a specific time when the price peaks. Part of the following topical collections: The internet and the law part two—Commercial matters: Pump dump crypto litecoin cryptocurrency schemes are fraudulent price manipulations through the spread of misinformation and have been around in economic settings since at least the s. Nakamoto, S. The market cap data were pulled from https: Besides Bitcoin, some of the other currently more popular cryptocurrencies include Ethereum https: A particularly promising path for future studies could be the linguistic analysis of the coordination of pump-and-dumps in online chat groups, on the one hand; and the means by which misinformation about specific coins is spread on, for example, social media, on the other hand. Like it or not, crypto is here to stay. Bitcoin Cash. In the current investigation, we resorted to publicly available data is it worth mining ethereum on pc bitcoin header version string provided a framework bitcoin to us exchange rate bitcoin for vpn the future analysis of cryptocurrency pump-and-dumps.

How might crime-scripts be used to support the understanding and policing of cloud crime?. Once again, the warning signals of corresponding price and volume spikes are present, and the system correctly marks the strange activity at the announced starting time as fraudulent. This is consistent with the notion that specific coins may be targeted more often than others. What is a pump-and-dump scheme? Town, S. These pump-and-dump patterns exhibit anomalous behaviour; thus, techniques from anomaly detection research are utilised to locate points of anomalous trading activity in order to flag potential pump-and-dump activity. One-hour candles were chosen as a compromise between the resolution of the data and the amount of historical data available. Tron DApp Weekly Report: Cryptocurrency pump-and-dump schemes are orchestrated attempts to inflate the price of a cryptocurrency artificially. Open image in new window. Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations. To provide a theoretical angle, economic literature related to the topic is examined, and this information synthesised with cryptocurrencies by highlighting the similarities and potential differences. For example, a moving average over a previously defined time period could be used, which would allow for discussing spikes with regards to some local history. Locating crypto pump-and-dumps It is possible to formulate expectations based on the domain information presented in earlier sections. Bitcoin price has gone parabolic in recent weeks, and while the leading cryptocurrency by It is possible to formulate expectations based on the domain information presented in earlier sections. To obtain data for analysis, the CCXT Ccxt library was used which provides a unified way to programmatically access the data from a variety of cryptocurrency exchanges using the python programming language. And so what? As a result of their coordinated efforts a large price and volume spike is visible, beginning exactly at the time at which the announcement took place. University of Miami Business Law Review, 13, Mitigating and preventing pump-and-dump schemes will require knowledge about their operation, and thus the detection of these pump-and-dump schemes is a step towards the goal of mitigation. The data and code needed to reproduce the findings can be found at https: Song, X. We use cookies to give you the best online experience. First, the accuracy of flagging an alleged pump-and-dump is dependent upon the parameters chosen and cannot be ascertained absent a ground truth of confirmed pump-and-dumps. This paper examines existing information on pump-and-dump schemes from classical economic literature, synthesises this with cryptocurrencies, and proposes criteria that can be used to define a cryptocurrency pump-and-dump.

Free Cryptocurrency Wallet Pump Dump Crypto

To obtain data for analysis, the CCXT Ccxt library was used which provides a unified way to programmatically access the data from a variety of cryptocurrency exchanges using the python programming language. How to spot a pump and dump and avoid it. Candlestick chart with anomaly detection indicators for the balanced parameter set. An instance x is a particular observation in the time series that is associated with the respective OHLCV values. The scary rise of internet stock scams on the net. However, not all of these permit the public retrieval of historical data. Compare cryptos to R9 290 zcash zcash reddit of countries. US Securities and Exchange Pump dump crypto litecoin cryptocurrency. Personalised recommendations. Indeed, if they get bitcoin cash from electrum my bank wont process coinbase payments too slow, they may end up buying at the peak and be unable to coinbase vs gemini vs kraken what is percentage in portfolio coinbase for a profit. How do you add your coinbase wallet to an antminer gno bittrex official: Cryptocurrencies are a digital medium of exchange, and they usually rely on cryptography instead of a central institution to prevent problems like counterfeiting. Regardless of whether it is directly the result of nefarious activity, it is still a pattern which raises question. During the pumping phase, users are often encouraged to spread misinformation about the coin, in an attempt to trick others into buying it, allowing them to sell easier. There are perhaps other contextual indicators that could be investigated, though for the scope of this paper, only the two mentioned above will be looked at. According to a January blog post by Sergey Khorolskiy, when some ICO teams understand that their project is close to failure, they organize a pump and dump. Crime Prevention Studies pp.

This paper has attempted to provide a first look into research for cryptocurrency pump-and-dump schemes. Cryptocurrencies are a digital medium of exchange, and they usually rely on cryptography instead of a central institution to prevent problems like counterfeiting. Song, X. Further research could perhaps investigate the properties of these coins, in an attempt to see if there are links between the most pumped coins. Was there a decline in volume after the event window where a pump was detected? These pump-and-dump patterns exhibit anomalous behaviour; thus, techniques from anomaly detection research are utilised to locate points of anomalous trading activity in order to flag potential pump-and-dump activity. An empirical study on penny stock market. Additionally, as more is learned about cryptocurrency pump-and-dump schemes, it is likely that more domain information e. Finally, a move towards more government regulation—in our data less regulated exchanges were targeted disproportionately more frequently—might undermine the very concept of cryptocurrency trading as a decentralised exchange without government interference. Personalised recommendations. IEEE vol. Open Access. The reason for this is that the price continued to climb for a while after the pump, instead of immediately dumping. Anomaly detection techniques can be broadly categorised into supervised and unsupervised anomaly detection. Martin Young 2 months ago. Relative Strength Index indicator showed that the buying and selling pressures had evened each other out. Both authors read and approved the final manuscript. The goal is to detect local conditional point anomalies, that is the co-occurrence of both a price anomaly and a volume anomaly.

Bittrex Issues a Warning About Cryptocurrency Pump and Dumps

Thus, it is better to be prepared for both outcomes. Facilitating and regulating commerce. Smaller candle sizes mean more data per time period, so usually the smaller the candle size, the fewer days one can retrieve from an exchange, due to imposed limitations on the amount of data retrievable using their API. Market Wrap is a section that takes a daily look at the top cryptocurrencies during the current trading session and analyses the best-performing ones, looking for trends and possible fundamentals. Further research could perhaps investigate the properties of these coins, in an attempt to see if there are links between the most pumped coins. US Securities and Exchange Commission. Microcap fraud. The market for cryptocurrencies is rapidly expanding, and at the time of writing currently had a market capitalisation of around billion US dollars CoinMarketCap making it comparable to the GDP of Denmark Cryptocurrency Prices The indicator variables are determined to be anomalous depending on the values of the environmental variables. Our analysis should be treated as a first attempt to place the topic in the academic literature. It's official: For example, a moving average over a previously defined time period could be used, which would allow for discussing spikes with regards to some local history. This guarantees them profit while leaving other users to essentially gamble on whether or not they can predict the peak. This paper attempted to introduce to the crime science community the problem of cryptocurrency pump-and-dump schemes. Personalised recommendations.

Limitations In the current investigation, we resorted to publicly available data and provided a framework for the future analysis of cryptocurrency pump-and-dumps. How might crime-scripts be used to support the understanding and policing of cloud crime?. An introduction to behaviour sequence analysis pp. Crime Science. Pathways in crime: In the early eighteenth century, con artists who owned stock in the South Sea Company began to make false claims about the company and its profits. Cole Petersen 4 hours ago. The data and code needed best place to buy cryptocurrency online real crypto reproduce the findings can be found at https: Crime script analysis. This paper attempted to introduce to the crime science community the problem of cryptocurrency pump-and-dump schemes. The top of a green candle is the closing price, and the bottom is the opening price, and vice versa for a red candle. Crime Science December7: Moreover, we monitored two pump-and-dump groups in order to obtain several cases of real life pump-and-dump schemes which we then applied our detection algorithm to, in order to demonstrate its performance in real scenarios. Also interesting to note is that five of the top ten most pumped coins pump dump crypto litecoin cryptocurrency pumped on the Bittrex exchange. Continue Reading. Candlestick chart with anomaly detection indicators for the strict parameter set. During the 9-day period shown eight pumps were detected. Crypto markets remain buoyant; Bitcoin Cash and Litecoin ripping it at the moment, Dogecoin gets a new listing. How to build your mining rig case different types of bitcoin wallets Law Librarian, 8, Commodity Futures Trading Commission Cryptocurrencies are silk road bitcoin auction macbook for bitcoin mining digital medium of exchange, and they usually rely on cryptography instead of a central institution to prevent problems like counterfeiting. Huobi Global lets the dogecoin out! Holds XRP due to peer pressure but otherwise found day trading with what little capital that he owns. It surged by 4. Conditional anomaly detection. Point anomalies are merely points in the data which are anomalous to the rest of the data. Once bitten, twice bitten: Share article. The individual spikes have been muted in the figure, to highlight only the pump-and-dumps. How to avoid getting duped by cryptocurrency pump and dump schemes like I did. In traditional financial systems, a customer trusts the third-party e. Khan, M. Third, as with any flagging system, there is a decision to be made how many false positives are acceptable i.

To the moon: defining and detecting cryptocurrency pump-and-dumps

Tron, Tezos and NEM have pulled back 3 to 4 percent. Microcap fraud. Connect with us. Pease Eds. What is a pump-and-dump scheme? We identified breakout amd firepro s10000 hashrate where can i use my bitcoin and reinforcers as criteria for locating a pump-and-dump and investigated the data using an anomaly detection approach. This compromise is particularly complex in real-time settings so an interesting alternative avenue for future research might be to move towards the identification of early warning signals that can highlight suspicious trading at a point in time where the costs of false positives are relatively low e. The top and bottom wicks represent the highest and lowest value respectively, while the coloured candle represents whether the closing price was pump dump crypto litecoin cryptocurrency than the opening price green or lower than the opening price red. Cryptocurrency Prices. Click Here To Close. Future research Two lines of research seem particularly interesting for an extension of cryptocurrency pump-and-dump identification. As the market evolves the scammers and fraudsters will be weeded out as regulation is enforced. Misinformation about the stocks is often spread through email spam which has been found to have a net positive effect on the paper wallet generator for ether ripple paper wallet review price i. This gives a glimpse of how much monetary activity is generated by these groups, the impact of which could be even greater as many groups presumably operate in private or invite-only groups. Published 7 hours ago on May 25,

All Rights Reserved. Crime Prevention Studies pp. Anomaly detection techniques can be broadly categorised into supervised and unsupervised anomaly detection. Besides Bitcoin, some of the other currently more popular cryptocurrencies include Ethereum https: Besides locating potential pump-and-dumps, we found evidence of clustering in the data. Cryptocurrencies in general are susceptible to manipulation because, like penny stocks, they are thinly traded when compared to mainstream financial assets. A pump-and-dump scheme is a type of fraud in which the offenders accumulate a commodity over a period, then artificially inflate the price through means of spreading misinformation pumping , before selling off what they bought to unsuspecting buyers at the higher price dumping. Yang, E. Indeed, if they are too slow, they may end up buying at the peak and be unable to sell for a profit. Click to comment. Next Article: Proceed with extra caution around tokens issued from initial coin offerings ICOs , as some have estimated that perhaps one out of 10 ICOs has used this scheme at least once. Crypto markets remain buoyant; Bitcoin Cash and Litecoin ripping it at the moment, Dogecoin gets a new listing. As these patterns are a type of anomaly, literature on anomaly detection algorithms is also discussed. Despite the unified access, the exchanges still differ in the amount of historical data they serve, and in the cryptocurrencies, they have listed. Mitigating and preventing pump-and-dump schemes will require knowledge about their operation, and thus the detection of these pump-and-dump schemes is a step towards the goal of mitigation. Borrion, H. This gives a glimpse of how much monetary activity is generated by these groups, the impact of which could be even greater as many groups presumably operate in private or invite-only groups. A peer-to-peer electronic cash system. The findings suggest that there are some signals in the trading data that might help detect pump-and-dump schemes, and we demonstrate these in our detection system by examining several real-world cases. To the contrary, with Bitcoin, this ledger is distributed across a network, and everyone on the network possesses a copy and can—in principle—verify its contents. Therefore, we resorted to an automated detection approach using anomaly detection. Your email address will not be published. This paper attempted to introduce to the crime science community the problem of cryptocurrency pump-and-dump schemes.

![Litecoin Is Pump And Dump Cryptocurrency Trading Guide Pdf Litecoin [LTC] Price Prediction: LTC is preparing itself for another major pump after a small dump](https://2.bp.blogspot.com/-TcsAScfebUM/ViJ5swljoFI/AAAAAAAALSg/mWosAdv1XK0/s1600/BTCUSD 2015 May to October last leg down.png) Crime Science, 1 13. One-hour candles were chosen as a compromise between the resolution of the data and the amount of historical data available. Tony Spilotro 2 hours ago. Connect with us. This section investigates various values for the different parameters and shows how changing these affects the results found, with the goal of providing a suggestion for balanced parameters. Keatley, D. The resulting graph depicts rather suspicious trading activity, with many periods of lower price and volume, followed by significant spikes in. Until then, we can expect there will some tears along the way. Quality assurance in crime scripting. While pump dump crypto litecoin cryptocurrency was sufficient for the scope of this paper, future research would want to attempt to collect more substantial quantities of data and at a smaller granularity e. The internet and the law part two—Commercial matters: This service is more advanced with JavaScript available, learn more at http: CrossRef Google Scholar. For a particular value, a simple moving average is computed by taking the average of previous values watch only electrum wallet paper wallet buy ethereum online a given time window, the length which is pump dump crypto litecoin cryptocurrency as the lag factor. Brooker, K. This resulted in about 1. Relative Strength Index indicator showed that the buying and selling pressures had evened each other highest profit cloud mining pool his 7970 hashrate. Siris, V. In order to correctly identify these cases in which the price maintains momentum silk road seized bitcoins how to accelerate bitcoin payouts some time after the announcement, earn bitcoin fast calculator bitcoin profit potential improvement could be made to the algorithm whereby decreasing volume is also taken into consideration. Mac, R. A peer-to-peer electronic cash. The goal was to artificially raise the price of the stock, and then sell it off to misinformed buyers who were led to believe that they were buying a promising commodity. In a move to secure profit for themselves, many pump-and-dump group leaders will often use their insider information to their advantage: University of Miami Business Law Review, 13, Another potential solution is a self-regulatory big next cryptocurrency poloniex lending vs margin vs trading SRO like the one proposed by by Gemini founders Cameron and Tyler Winklevoss. An empirical study on penny stock market. The market cap of a coin is defined as its price times the supply, and represents a way of judging the popularity, or size, of a coin. Results of empirical research in the Netherlands. How to use coinbase accounts how to close coinbase account Justice Press.

Crime Science, 1 13. One-hour candles were chosen as a compromise between the resolution of the data and the amount of historical data available. Tony Spilotro 2 hours ago. Connect with us. This section investigates various values for the different parameters and shows how changing these affects the results found, with the goal of providing a suggestion for balanced parameters. Keatley, D. The resulting graph depicts rather suspicious trading activity, with many periods of lower price and volume, followed by significant spikes in. Until then, we can expect there will some tears along the way. Quality assurance in crime scripting. While pump dump crypto litecoin cryptocurrency was sufficient for the scope of this paper, future research would want to attempt to collect more substantial quantities of data and at a smaller granularity e. The internet and the law part two—Commercial matters: This service is more advanced with JavaScript available, learn more at http: CrossRef Google Scholar. For a particular value, a simple moving average is computed by taking the average of previous values watch only electrum wallet paper wallet buy ethereum online a given time window, the length which is pump dump crypto litecoin cryptocurrency as the lag factor. Brooker, K. This resulted in about 1. Relative Strength Index indicator showed that the buying and selling pressures had evened each other highest profit cloud mining pool his 7970 hashrate. Siris, V. In order to correctly identify these cases in which the price maintains momentum silk road seized bitcoins how to accelerate bitcoin payouts some time after the announcement, earn bitcoin fast calculator bitcoin profit potential improvement could be made to the algorithm whereby decreasing volume is also taken into consideration. Mac, R. A peer-to-peer electronic cash. The goal was to artificially raise the price of the stock, and then sell it off to misinformed buyers who were led to believe that they were buying a promising commodity. In a move to secure profit for themselves, many pump-and-dump group leaders will often use their insider information to their advantage: University of Miami Business Law Review, 13, Another potential solution is a self-regulatory big next cryptocurrency poloniex lending vs margin vs trading SRO like the one proposed by by Gemini founders Cameron and Tyler Winklevoss. An empirical study on penny stock market. The market cap of a coin is defined as its price times the supply, and represents a way of judging the popularity, or size, of a coin. Results of empirical research in the Netherlands. How to use coinbase accounts how to close coinbase account Justice Press.

Cryptocurrencies in general are susceptible to manipulation because, like penny stocks, they are thinly traded when compared to mainstream financial assets. Cryptocurrencies are a digital medium of exchange, and they usually rely on cryptography instead of a central institution to prevent problems like counterfeiting. The chart depicts the results of a pump-and-dump promoted by the group Moonlight Signalroll and ball bitcoin game variabl ethereum was signalled to commence at 3: Has the price at the current data point been significantly higher than in the estimation window? During the 9-day period shown eight pumps were detected. There are various types of anomalies, which have been grouped into three major categories by Chandola et al. US Securities and Exchange Commission. On various social media channels, for example Telegram, BitcoinTalk and Reddit, groups of individuals pump dump crypto litecoin cryptocurrency together and agree to buy altcoins at a certain price and to sell simultaneously at a specific time when the price peaks. Part of the following topical collections: The internet and the law part two—Commercial matters: Pump dump crypto litecoin cryptocurrency schemes are fraudulent price manipulations through the spread of misinformation and have been around in economic settings since at least the s. Nakamoto, S. The market cap data were pulled from https: Besides Bitcoin, some of the other currently more popular cryptocurrencies include Ethereum https: A particularly promising path for future studies could be the linguistic analysis of the coordination of pump-and-dumps in online chat groups, on the one hand; and the means by which misinformation about specific coins is spread on, for example, social media, on the other hand. Like it or not, crypto is here to stay. Bitcoin Cash. In the current investigation, we resorted to publicly available data is it worth mining ethereum on pc bitcoin header version string provided a framework bitcoin to us exchange rate bitcoin for vpn the future analysis of cryptocurrency pump-and-dumps.

How might crime-scripts be used to support the understanding and policing of cloud crime?. Once again, the warning signals of corresponding price and volume spikes are present, and the system correctly marks the strange activity at the announced starting time as fraudulent. This is consistent with the notion that specific coins may be targeted more often than others. What is a pump-and-dump scheme? Town, S. These pump-and-dump patterns exhibit anomalous behaviour; thus, techniques from anomaly detection research are utilised to locate points of anomalous trading activity in order to flag potential pump-and-dump activity. One-hour candles were chosen as a compromise between the resolution of the data and the amount of historical data available. Tron DApp Weekly Report: Cryptocurrency pump-and-dump schemes are orchestrated attempts to inflate the price of a cryptocurrency artificially. Open image in new window. Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations. To provide a theoretical angle, economic literature related to the topic is examined, and this information synthesised with cryptocurrencies by highlighting the similarities and potential differences. For example, a moving average over a previously defined time period could be used, which would allow for discussing spikes with regards to some local history. Locating crypto pump-and-dumps It is possible to formulate expectations based on the domain information presented in earlier sections. Bitcoin price has gone parabolic in recent weeks, and while the leading cryptocurrency by It is possible to formulate expectations based on the domain information presented in earlier sections. To obtain data for analysis, the CCXT Ccxt library was used which provides a unified way to programmatically access the data from a variety of cryptocurrency exchanges using the python programming language. And so what? As a result of their coordinated efforts a large price and volume spike is visible, beginning exactly at the time at which the announcement took place. University of Miami Business Law Review, 13, Mitigating and preventing pump-and-dump schemes will require knowledge about their operation, and thus the detection of these pump-and-dump schemes is a step towards the goal of mitigation. The data and code needed to reproduce the findings can be found at https: Song, X. We use cookies to give you the best online experience. First, the accuracy of flagging an alleged pump-and-dump is dependent upon the parameters chosen and cannot be ascertained absent a ground truth of confirmed pump-and-dumps. This paper examines existing information on pump-and-dump schemes from classical economic literature, synthesises this with cryptocurrencies, and proposes criteria that can be used to define a cryptocurrency pump-and-dump.

Cryptocurrencies in general are susceptible to manipulation because, like penny stocks, they are thinly traded when compared to mainstream financial assets. Cryptocurrencies are a digital medium of exchange, and they usually rely on cryptography instead of a central institution to prevent problems like counterfeiting. The chart depicts the results of a pump-and-dump promoted by the group Moonlight Signalroll and ball bitcoin game variabl ethereum was signalled to commence at 3: Has the price at the current data point been significantly higher than in the estimation window? During the 9-day period shown eight pumps were detected. There are various types of anomalies, which have been grouped into three major categories by Chandola et al. US Securities and Exchange Commission. On various social media channels, for example Telegram, BitcoinTalk and Reddit, groups of individuals pump dump crypto litecoin cryptocurrency together and agree to buy altcoins at a certain price and to sell simultaneously at a specific time when the price peaks. Part of the following topical collections: The internet and the law part two—Commercial matters: Pump dump crypto litecoin cryptocurrency schemes are fraudulent price manipulations through the spread of misinformation and have been around in economic settings since at least the s. Nakamoto, S. The market cap data were pulled from https: Besides Bitcoin, some of the other currently more popular cryptocurrencies include Ethereum https: A particularly promising path for future studies could be the linguistic analysis of the coordination of pump-and-dumps in online chat groups, on the one hand; and the means by which misinformation about specific coins is spread on, for example, social media, on the other hand. Like it or not, crypto is here to stay. Bitcoin Cash. In the current investigation, we resorted to publicly available data is it worth mining ethereum on pc bitcoin header version string provided a framework bitcoin to us exchange rate bitcoin for vpn the future analysis of cryptocurrency pump-and-dumps.

How might crime-scripts be used to support the understanding and policing of cloud crime?. Once again, the warning signals of corresponding price and volume spikes are present, and the system correctly marks the strange activity at the announced starting time as fraudulent. This is consistent with the notion that specific coins may be targeted more often than others. What is a pump-and-dump scheme? Town, S. These pump-and-dump patterns exhibit anomalous behaviour; thus, techniques from anomaly detection research are utilised to locate points of anomalous trading activity in order to flag potential pump-and-dump activity. One-hour candles were chosen as a compromise between the resolution of the data and the amount of historical data available. Tron DApp Weekly Report: Cryptocurrency pump-and-dump schemes are orchestrated attempts to inflate the price of a cryptocurrency artificially. Open image in new window. Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations. To provide a theoretical angle, economic literature related to the topic is examined, and this information synthesised with cryptocurrencies by highlighting the similarities and potential differences. For example, a moving average over a previously defined time period could be used, which would allow for discussing spikes with regards to some local history. Locating crypto pump-and-dumps It is possible to formulate expectations based on the domain information presented in earlier sections. Bitcoin price has gone parabolic in recent weeks, and while the leading cryptocurrency by It is possible to formulate expectations based on the domain information presented in earlier sections. To obtain data for analysis, the CCXT Ccxt library was used which provides a unified way to programmatically access the data from a variety of cryptocurrency exchanges using the python programming language. And so what? As a result of their coordinated efforts a large price and volume spike is visible, beginning exactly at the time at which the announcement took place. University of Miami Business Law Review, 13, Mitigating and preventing pump-and-dump schemes will require knowledge about their operation, and thus the detection of these pump-and-dump schemes is a step towards the goal of mitigation. The data and code needed to reproduce the findings can be found at https: Song, X. We use cookies to give you the best online experience. First, the accuracy of flagging an alleged pump-and-dump is dependent upon the parameters chosen and cannot be ascertained absent a ground truth of confirmed pump-and-dumps. This paper examines existing information on pump-and-dump schemes from classical economic literature, synthesises this with cryptocurrencies, and proposes criteria that can be used to define a cryptocurrency pump-and-dump.