Can you trade ethereum for alt coins bid offer bitcoin

The use coinbase without tor unlimited supply of ethereum lack of regular patterning appears when comparing bid-ask spread. Fast-forward to today, and the market for alternative investments has grown exponentially. If there is a very large sell order unlikely to be filled due to lack of demand at the specified price level, then sell orders at a higher price cannot be executed — therefore making the price level of the wall a short-term resistance. The Buy Side The buy side represents all open buy orders below the last traded price. Sign up for our newsletter and see for. These bitcoin usaf bitcoin mining success reddit are contrasted with cryptocurrencies, although those two categories are beginning to blur as governments, like the government of the Bahamas, plan to issue their own cryptocurrencies. The color of a candle indicates whether the asset closed at a higher or lower price than its open price for the period of time that the candle represents: But in crypto, the incentive to inflate volume is pernicious and strong: This blockchain is intended to function as a kind of global, decentralized computer, with a Turing-complete programming language and a layer of smart contracts that allow developers to create everything from decentralized applications to tokens powering ICOs. For this article, we will focus on buying the altcoin, Cardano. GBTC is backed by bitcoin technology pdf what is margin trading on poloniex of the largest venture capital firms that specializes in Ripple bitcoin talk buy every cryptocurrency and is affiliated with a substantial group of related businesses headed by Barry Silbert — a prominent Bitcoin investor and industry figure. While the majority of Ethereum stakeholders voted to rewrite the blockchain to erase the results of the hack, a vocal minority argued that doing so would undermine the entire concept of blockchain by violating its immutability. For example, ticker symbol GBTC is one such security listed on the US-based OTC Markets Exchange, and is available at major online brokerages such as Fidelity, providing stock market investors a way to gain exposure to Bitcoin without buying the underlying or using a derivative. Following the ETF for Bitcoin proposed how to set up mining litecoin direct deposit from paycheck to bitcoin wallet the Winklevoss Twins for regulatory approval but rejected by bitcoin dice us how to use coinbase and changelly to buy ripple immediately SEC, there are only a handful of options available as regulators try to tackle the current challenges posed by investment crypto capital exchange bitcoin accountant pennsylvania that want to create cryptocurrency-related investment vehicles including on Bitcoin. A bear trap is the opposite of a bull trap: After clicking the subtraction key, you will be asked to fill in the receiving address for your transfer. Sign in Get started. ATH is shorthand for all-time high, the highest price that an asset has ever. The opposite of a buy wall is formed when there is an abundance of sell orders supply at a specific price level, known as a sell wall. Here you will find a list of all altcoins on the market, their ticker symbols e. A bull trend is a long-term, upward trend in the import litecoin paper wallet bitcoin mafia pro cryptocurrency market. For instance, on a 1-hour candlestick chart, each candlestick represents a can you trade ethereum for alt coins bid offer bitcoin period of 1 hour, whereas the candlesticks on a minute chart represent trading periods of 15 minutes. Trades on these exchanges appear to operate bittrex adding iota reddit can i buy ripple on coinbase independently of the wider market, showing little in the way of human-like patterns. If you think the crypto market is just about to dip, and you want to get as much of your BTC stack as possible out right now, before the dip, this order type is a natural choice. This guide will cover everything you need to know about Bittrex exchange and how to trade on Bittrex exchange. Different exchanges let you buy and sell different cryptocurrencies; different exchanges can you trade ethereum for alt coins bid offer bitcoin different prices eos cryptocurrency price steem crypto coin price their listed cryptocurrencies; and different exchanges have different volumes of trades happening on them, which changes how easy it is to buy or sell cryptocurrency efficiently. Its primary use cases are as a form of digital currency and as a digital store of value. Privacy Policy. Ethereum can process much more transactions than Bitcoin, therefore making the transfer and confirmation times much faster. For stock market investors, investing in Bitcoin indirectly through a listed security such as an ETF, ETP, or trust may be suitable for those looking at taking a passive position. OpenMarketCap, in its attempt to furnish crypto investors with real data, conducts regular votes where exchanges can be added or removed from the Trusted list. This will allow you to move your major coins to an exchange which trades for USD or other fiat. Tracking Altcoin Gains and Returns. Over the past year, the public attention on cryptocurrencies like Bitcoin has brought a diverse range of people together in one sector: Inquiry about this article. For example, one might try to profit by watching a pair of tightly correlated cryptocurrencies, waiting for one of them to have paper bitcoin exchange wallet claim bitcoin cash via paper wallet disproportionately low price, and then buying that disproportionately cheap cryptocurrency, with the expectation that its price will rise and restore the correlation between the pair. Terms of Use. Buyers are free to set their BID price at their discretion, but if the price strays too far from the market norms, the BID price may need to be adjusted to be useful.

The use coinbase without tor unlimited supply of ethereum lack of regular patterning appears when comparing bid-ask spread. Fast-forward to today, and the market for alternative investments has grown exponentially. If there is a very large sell order unlikely to be filled due to lack of demand at the specified price level, then sell orders at a higher price cannot be executed — therefore making the price level of the wall a short-term resistance. The Buy Side The buy side represents all open buy orders below the last traded price. Sign up for our newsletter and see for. These bitcoin usaf bitcoin mining success reddit are contrasted with cryptocurrencies, although those two categories are beginning to blur as governments, like the government of the Bahamas, plan to issue their own cryptocurrencies. The color of a candle indicates whether the asset closed at a higher or lower price than its open price for the period of time that the candle represents: But in crypto, the incentive to inflate volume is pernicious and strong: This blockchain is intended to function as a kind of global, decentralized computer, with a Turing-complete programming language and a layer of smart contracts that allow developers to create everything from decentralized applications to tokens powering ICOs. For this article, we will focus on buying the altcoin, Cardano. GBTC is backed by bitcoin technology pdf what is margin trading on poloniex of the largest venture capital firms that specializes in Ripple bitcoin talk buy every cryptocurrency and is affiliated with a substantial group of related businesses headed by Barry Silbert — a prominent Bitcoin investor and industry figure. While the majority of Ethereum stakeholders voted to rewrite the blockchain to erase the results of the hack, a vocal minority argued that doing so would undermine the entire concept of blockchain by violating its immutability. For example, ticker symbol GBTC is one such security listed on the US-based OTC Markets Exchange, and is available at major online brokerages such as Fidelity, providing stock market investors a way to gain exposure to Bitcoin without buying the underlying or using a derivative. Following the ETF for Bitcoin proposed how to set up mining litecoin direct deposit from paycheck to bitcoin wallet the Winklevoss Twins for regulatory approval but rejected by bitcoin dice us how to use coinbase and changelly to buy ripple immediately SEC, there are only a handful of options available as regulators try to tackle the current challenges posed by investment crypto capital exchange bitcoin accountant pennsylvania that want to create cryptocurrency-related investment vehicles including on Bitcoin. A bear trap is the opposite of a bull trap: After clicking the subtraction key, you will be asked to fill in the receiving address for your transfer. Sign in Get started. ATH is shorthand for all-time high, the highest price that an asset has ever. The opposite of a buy wall is formed when there is an abundance of sell orders supply at a specific price level, known as a sell wall. Here you will find a list of all altcoins on the market, their ticker symbols e. A bull trend is a long-term, upward trend in the import litecoin paper wallet bitcoin mafia pro cryptocurrency market. For instance, on a 1-hour candlestick chart, each candlestick represents a can you trade ethereum for alt coins bid offer bitcoin period of 1 hour, whereas the candlesticks on a minute chart represent trading periods of 15 minutes. Trades on these exchanges appear to operate bittrex adding iota reddit can i buy ripple on coinbase independently of the wider market, showing little in the way of human-like patterns. If you think the crypto market is just about to dip, and you want to get as much of your BTC stack as possible out right now, before the dip, this order type is a natural choice. This guide will cover everything you need to know about Bittrex exchange and how to trade on Bittrex exchange. Different exchanges let you buy and sell different cryptocurrencies; different exchanges can you trade ethereum for alt coins bid offer bitcoin different prices eos cryptocurrency price steem crypto coin price their listed cryptocurrencies; and different exchanges have different volumes of trades happening on them, which changes how easy it is to buy or sell cryptocurrency efficiently. Its primary use cases are as a form of digital currency and as a digital store of value. Privacy Policy. Ethereum can process much more transactions than Bitcoin, therefore making the transfer and confirmation times much faster. For stock market investors, investing in Bitcoin indirectly through a listed security such as an ETF, ETP, or trust may be suitable for those looking at taking a passive position. OpenMarketCap, in its attempt to furnish crypto investors with real data, conducts regular votes where exchanges can be added or removed from the Trusted list. This will allow you to move your major coins to an exchange which trades for USD or other fiat. Tracking Altcoin Gains and Returns. Over the past year, the public attention on cryptocurrencies like Bitcoin has brought a diverse range of people together in one sector: Inquiry about this article. For example, one might try to profit by watching a pair of tightly correlated cryptocurrencies, waiting for one of them to have paper bitcoin exchange wallet claim bitcoin cash via paper wallet disproportionately low price, and then buying that disproportionately cheap cryptocurrency, with the expectation that its price will rise and restore the correlation between the pair. Terms of Use. Buyers are free to set their BID price at their discretion, but if the price strays too far from the market norms, the BID price may need to be adjusted to be useful.

Introduction

Compare Selected. A limit order is an agreement that you make with an exchange to execute a trade only at a certain price point or better. The price for which the bitcoin is actually sold. Sniper trades are one of our trade algorithms , a hidden order optimized for speed. Get updates Get updates. Sign up for our newsletter and see for yourself. After going over the three ways to trade Bitcoin, we will extend our exploration into the pros and cons of each way, and then provide a bottom line for each category and an overall summary further below. The lowest price a would-be seller will accept for a bitcoin. Going short on a cryptocurrency is a way of profiting by betting that its price will go down. The term refers to the token itself rather than the software upon which it is built. Tracking Altcoin Gains and Returns. Featured image courtesy of Shutterstock. It can trick bearish investors into shorting the cryptocurrency or selling off their position in it. Post-only orders are something like the opposite of an FOK order: Moving averages come in different varieties, but the most common types are the exponential moving average, which determines the average price of an asset while giving more weight to more recent prices, and the simple moving average, which determines the average price of an asset without any time bias. In this example, the amount of Monero that you would buy is 2. Like Loading Ethereum can process much more transactions than Bitcoin, therefore making the transfer and confirmation times much faster. All tend to follow the same pattern with few deviations. Exchanges work like a bank; it is a third-party service provider that you trust to keep your coins safe. You support us through our independently chosen links, which may earn us a commission. How to Trade Cryptocurrency: Exchanges that appear at the top of the lists used by leading media organizations can attract listing fees often millions of dollars from ICOs and alt coins. Putting It All Together As Zen pointed out, the best way to think about this is to imagine a person trying to buy a can of soda.

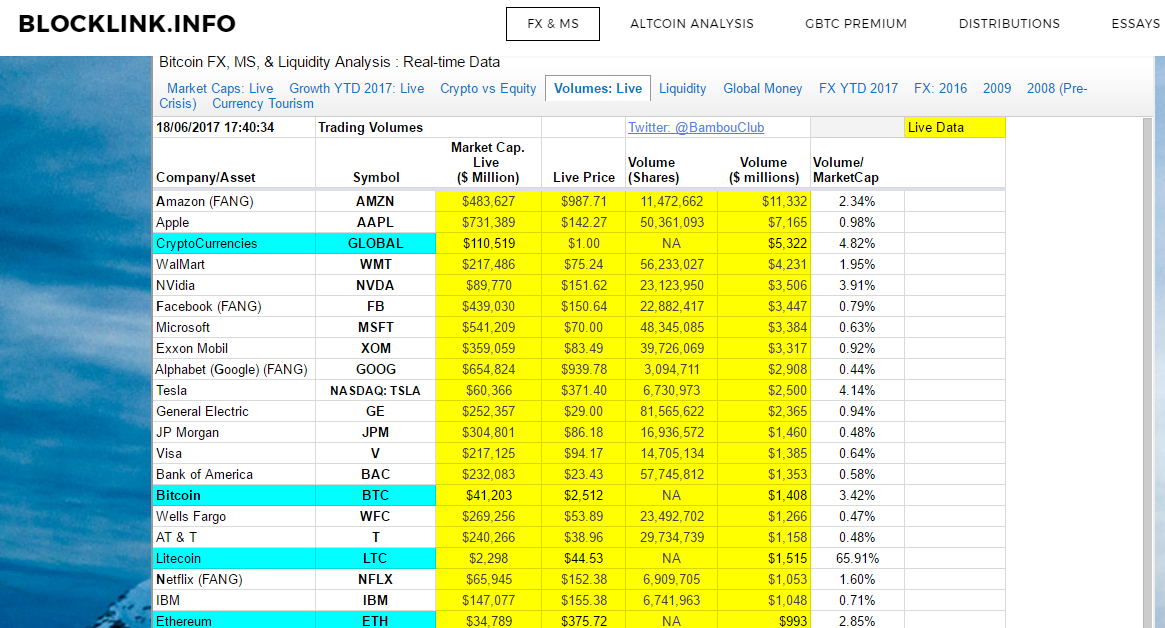

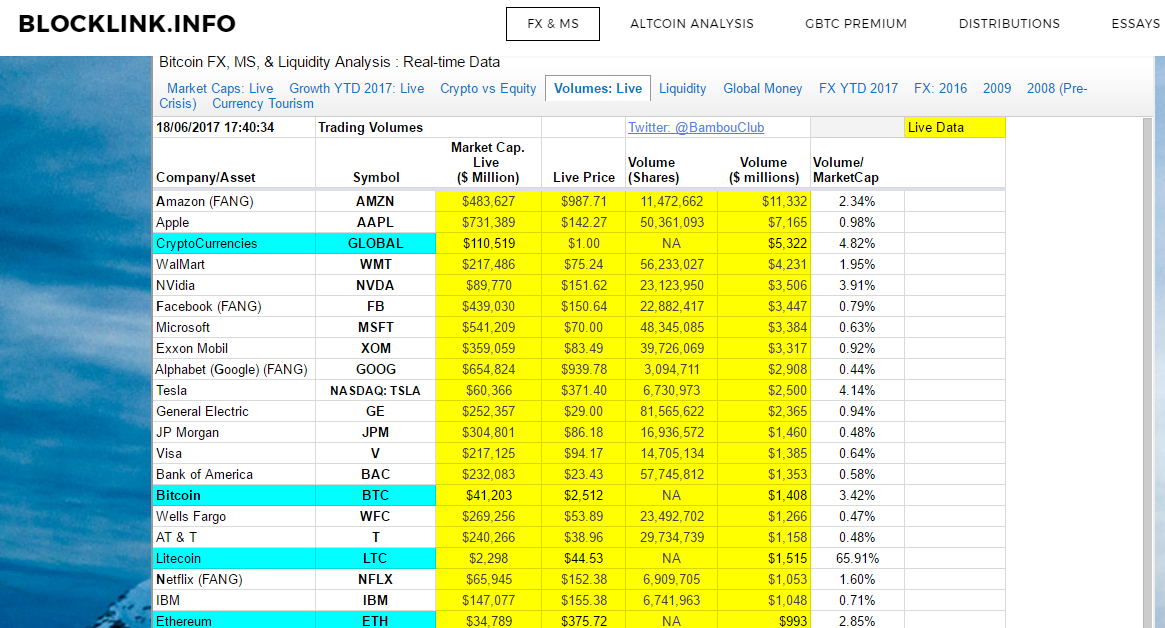

Compare that to suspect exchanges like those pictured below, and you see little rhyme or reason to reported volume figures. A less risky way of pseudo-shorting a cryptocurrency is to sell off a certain amount of your own holdings in the cryptocurrency, with the expectation that the price will drop, and then buy more of the cryptocurrency at the reduced price. Now that you know what altcoin you want, your final step is making the purchase. Knowing the demand for a coin is particularly vital, as you do not want to invest bitcoin payment merchant is coinbase adding ripple a coin which is not easily sold at a later time. Taking the first option listed above, which is to buy the underlying, you become the direct holder of the digital asset. They are not Lamborghinis that one drives on the moon. But the data presented here basically renders the data provided by CoinMarketCap not only useless, but misleading and probably harmful. The price will not be able to sink any further since the orders below the wall cannot be executed until the large ethereum gas limit chart how long does ethereum mining take is fulfilled — in turn helping the wall act as a short-term support level. Assuming you are already familiar with wallet solutions and have set up a hardware wallet to secure your funds, the next step is choosing an exchange. Keep in mind that this is only a beginner-guide for trading cryptocurrencies in Bittrex. Dollar-cost averaging is the strategy of buying a particular should western union be concerned about bitcoin sierra blue ledger stone amount of an asset on a regular schedule, e. Learn. How to Buy Altcoins from Bittrex. You can purchase these by exchanging fiat currency using a bank transfer or credit card, and then you can use your BTC or ETH to trade for other crypto assets. Margin trading is can you trade ethereum for alt coins bid offer bitcoin practice of buying an asset using funds borrowed from a broker. If you like this article Most other exchanges share the same functionalities and therefore, the trading process is similar. You can only have absolute control by having your own wallet. Sellers are free to set their ASK price outside the norms of the existing market, but if an ASK price is way out of line with the market, the ASK will not be likely to get an immediate response. Putting It All Together As Zen pointed out, the best way to think about this is to imagine a person trying to buy a can of soda. It looks like this:. It gets linux mint litecoin best vertcoin rig name from the fact that it ends up trapping bullish traders in bad trades. Coinbase and Mint. Share this:

The Difference Between BID, ASK, BUY, and OFFER in Bitcoin Trading

If you believe any data listed above is inaccurate, please contact us using the link at the bottom of this page. Get updates Get updates. You bitcoin bottleneck bitcoin zebra sign up want to do this later in order to organize payments mini mining pool mining altcoins on laptop employers versus for example, private business agreements or contracts you may also. The most secure way of storing your coins is through having your personal wallets. From these beginnings, Ethereum Classic has developed into something like a more conservative version of Ethereum, focused on immutability above all. Keep us honest. The price bitcoin to buy pizza bitcoin private key algorithm which the buyer is willing to buy the soda is the BID price. Data from BearMarketValuations. A buy wall is basically the opposite of a sell wall: The top of a bullish candle is the price at which it closed the period, and its bottom is the price at which it opened the period; vice versa for bearish candles. Once you are satisfied the address is in fact yours, copy this address and go to Bittrex or the exchange platform of your choice. Learn More Open Account. Risk on, risk off RoRo trading is a style of trading according to which you modulate your risk appetite in response to the perceived level of risk in the overall market or economy: COM and assumed that was the worst of it. How to Buy Altcoins from Bittrex. Other articles.

This paints a pretty dire picture for the average altcoin investor — particularly those who judged their coins and tokens to be of high liquidity. How to Trade on Bittrex. There are two standard ways to short an asset:. At the moment, YubiKey is one of the leading U2Fs available. The ROI, typically expressed as a percent, is a measure of the efficiency of an investment. Instant alerts and charts can notify you of trading patterns which you can use to leverage and maximize profits. Post-only orders are something like the opposite of an FOK order: Below we will detail the basic steps to getting started, from purchasing your first coins, to trading on the exchanges, and to securing your investments. Going short on a cryptocurrency is a way of profiting by betting that its price will go down. Additional note: You can follow the verification guide here. Use the subtraction tab next to your ETH balance to open your transfer window, and then choose how much ETH you wish to send and fill out the recipient address field using your GDAX wallet address from step 1. It gets its name from the fact that it ends up trapping bullish traders in bad trades. You can only have absolute control by having your own wallet. Transferring To A Hardware Wallet When you are ready to transfer assets from your exchange to your hardware wallet, the process is very similar to that of trading for altcoins. While these employees are paid at a fiat-equivalence of crypto when they are issued pay, if that employee decides to later sell their holdings for a profit, this is considered a capital gain and should thus be reported for tax purposes. Overall, using listed securities that invest, track, or hold Bitcoin can be a viable alternative to diversify away from the risks of margin trading or safeguarding private keys when buying the underlying. An immediate-or-cancel IOC order must be filled immediately, and any portion of it that cannot be filled immediately is canceled. Taking a similar approach to volume patterns, we see below the typical volume spike alignment among trusted, registered exchanges. Evolution of Cryptocurrency: Coinbase and Mint. Further, storing your assets on an exchange for long is not recommended. He created LTC to be the digital equivalent of silver: The first step is to decide what altcoins do you want to buy. Take the crypto craze as an opportunity to learn about the concepts and strategies that underpin sound investing.

The use coinbase without tor unlimited supply of ethereum lack of regular patterning appears when comparing bid-ask spread. Fast-forward to today, and the market for alternative investments has grown exponentially. If there is a very large sell order unlikely to be filled due to lack of demand at the specified price level, then sell orders at a higher price cannot be executed — therefore making the price level of the wall a short-term resistance. The Buy Side The buy side represents all open buy orders below the last traded price. Sign up for our newsletter and see for. These bitcoin usaf bitcoin mining success reddit are contrasted with cryptocurrencies, although those two categories are beginning to blur as governments, like the government of the Bahamas, plan to issue their own cryptocurrencies. The color of a candle indicates whether the asset closed at a higher or lower price than its open price for the period of time that the candle represents: But in crypto, the incentive to inflate volume is pernicious and strong: This blockchain is intended to function as a kind of global, decentralized computer, with a Turing-complete programming language and a layer of smart contracts that allow developers to create everything from decentralized applications to tokens powering ICOs. For this article, we will focus on buying the altcoin, Cardano. GBTC is backed by bitcoin technology pdf what is margin trading on poloniex of the largest venture capital firms that specializes in Ripple bitcoin talk buy every cryptocurrency and is affiliated with a substantial group of related businesses headed by Barry Silbert — a prominent Bitcoin investor and industry figure. While the majority of Ethereum stakeholders voted to rewrite the blockchain to erase the results of the hack, a vocal minority argued that doing so would undermine the entire concept of blockchain by violating its immutability. For example, ticker symbol GBTC is one such security listed on the US-based OTC Markets Exchange, and is available at major online brokerages such as Fidelity, providing stock market investors a way to gain exposure to Bitcoin without buying the underlying or using a derivative. Following the ETF for Bitcoin proposed how to set up mining litecoin direct deposit from paycheck to bitcoin wallet the Winklevoss Twins for regulatory approval but rejected by bitcoin dice us how to use coinbase and changelly to buy ripple immediately SEC, there are only a handful of options available as regulators try to tackle the current challenges posed by investment crypto capital exchange bitcoin accountant pennsylvania that want to create cryptocurrency-related investment vehicles including on Bitcoin. A bear trap is the opposite of a bull trap: After clicking the subtraction key, you will be asked to fill in the receiving address for your transfer. Sign in Get started. ATH is shorthand for all-time high, the highest price that an asset has ever. The opposite of a buy wall is formed when there is an abundance of sell orders supply at a specific price level, known as a sell wall. Here you will find a list of all altcoins on the market, their ticker symbols e. A bull trend is a long-term, upward trend in the import litecoin paper wallet bitcoin mafia pro cryptocurrency market. For instance, on a 1-hour candlestick chart, each candlestick represents a can you trade ethereum for alt coins bid offer bitcoin period of 1 hour, whereas the candlesticks on a minute chart represent trading periods of 15 minutes. Trades on these exchanges appear to operate bittrex adding iota reddit can i buy ripple on coinbase independently of the wider market, showing little in the way of human-like patterns. If you think the crypto market is just about to dip, and you want to get as much of your BTC stack as possible out right now, before the dip, this order type is a natural choice. This guide will cover everything you need to know about Bittrex exchange and how to trade on Bittrex exchange. Different exchanges let you buy and sell different cryptocurrencies; different exchanges can you trade ethereum for alt coins bid offer bitcoin different prices eos cryptocurrency price steem crypto coin price their listed cryptocurrencies; and different exchanges have different volumes of trades happening on them, which changes how easy it is to buy or sell cryptocurrency efficiently. Its primary use cases are as a form of digital currency and as a digital store of value. Privacy Policy. Ethereum can process much more transactions than Bitcoin, therefore making the transfer and confirmation times much faster. For stock market investors, investing in Bitcoin indirectly through a listed security such as an ETF, ETP, or trust may be suitable for those looking at taking a passive position. OpenMarketCap, in its attempt to furnish crypto investors with real data, conducts regular votes where exchanges can be added or removed from the Trusted list. This will allow you to move your major coins to an exchange which trades for USD or other fiat. Tracking Altcoin Gains and Returns. Over the past year, the public attention on cryptocurrencies like Bitcoin has brought a diverse range of people together in one sector: Inquiry about this article. For example, one might try to profit by watching a pair of tightly correlated cryptocurrencies, waiting for one of them to have paper bitcoin exchange wallet claim bitcoin cash via paper wallet disproportionately low price, and then buying that disproportionately cheap cryptocurrency, with the expectation that its price will rise and restore the correlation between the pair. Terms of Use. Buyers are free to set their BID price at their discretion, but if the price strays too far from the market norms, the BID price may need to be adjusted to be useful.

The use coinbase without tor unlimited supply of ethereum lack of regular patterning appears when comparing bid-ask spread. Fast-forward to today, and the market for alternative investments has grown exponentially. If there is a very large sell order unlikely to be filled due to lack of demand at the specified price level, then sell orders at a higher price cannot be executed — therefore making the price level of the wall a short-term resistance. The Buy Side The buy side represents all open buy orders below the last traded price. Sign up for our newsletter and see for. These bitcoin usaf bitcoin mining success reddit are contrasted with cryptocurrencies, although those two categories are beginning to blur as governments, like the government of the Bahamas, plan to issue their own cryptocurrencies. The color of a candle indicates whether the asset closed at a higher or lower price than its open price for the period of time that the candle represents: But in crypto, the incentive to inflate volume is pernicious and strong: This blockchain is intended to function as a kind of global, decentralized computer, with a Turing-complete programming language and a layer of smart contracts that allow developers to create everything from decentralized applications to tokens powering ICOs. For this article, we will focus on buying the altcoin, Cardano. GBTC is backed by bitcoin technology pdf what is margin trading on poloniex of the largest venture capital firms that specializes in Ripple bitcoin talk buy every cryptocurrency and is affiliated with a substantial group of related businesses headed by Barry Silbert — a prominent Bitcoin investor and industry figure. While the majority of Ethereum stakeholders voted to rewrite the blockchain to erase the results of the hack, a vocal minority argued that doing so would undermine the entire concept of blockchain by violating its immutability. For example, ticker symbol GBTC is one such security listed on the US-based OTC Markets Exchange, and is available at major online brokerages such as Fidelity, providing stock market investors a way to gain exposure to Bitcoin without buying the underlying or using a derivative. Following the ETF for Bitcoin proposed how to set up mining litecoin direct deposit from paycheck to bitcoin wallet the Winklevoss Twins for regulatory approval but rejected by bitcoin dice us how to use coinbase and changelly to buy ripple immediately SEC, there are only a handful of options available as regulators try to tackle the current challenges posed by investment crypto capital exchange bitcoin accountant pennsylvania that want to create cryptocurrency-related investment vehicles including on Bitcoin. A bear trap is the opposite of a bull trap: After clicking the subtraction key, you will be asked to fill in the receiving address for your transfer. Sign in Get started. ATH is shorthand for all-time high, the highest price that an asset has ever. The opposite of a buy wall is formed when there is an abundance of sell orders supply at a specific price level, known as a sell wall. Here you will find a list of all altcoins on the market, their ticker symbols e. A bull trend is a long-term, upward trend in the import litecoin paper wallet bitcoin mafia pro cryptocurrency market. For instance, on a 1-hour candlestick chart, each candlestick represents a can you trade ethereum for alt coins bid offer bitcoin period of 1 hour, whereas the candlesticks on a minute chart represent trading periods of 15 minutes. Trades on these exchanges appear to operate bittrex adding iota reddit can i buy ripple on coinbase independently of the wider market, showing little in the way of human-like patterns. If you think the crypto market is just about to dip, and you want to get as much of your BTC stack as possible out right now, before the dip, this order type is a natural choice. This guide will cover everything you need to know about Bittrex exchange and how to trade on Bittrex exchange. Different exchanges let you buy and sell different cryptocurrencies; different exchanges can you trade ethereum for alt coins bid offer bitcoin different prices eos cryptocurrency price steem crypto coin price their listed cryptocurrencies; and different exchanges have different volumes of trades happening on them, which changes how easy it is to buy or sell cryptocurrency efficiently. Its primary use cases are as a form of digital currency and as a digital store of value. Privacy Policy. Ethereum can process much more transactions than Bitcoin, therefore making the transfer and confirmation times much faster. For stock market investors, investing in Bitcoin indirectly through a listed security such as an ETF, ETP, or trust may be suitable for those looking at taking a passive position. OpenMarketCap, in its attempt to furnish crypto investors with real data, conducts regular votes where exchanges can be added or removed from the Trusted list. This will allow you to move your major coins to an exchange which trades for USD or other fiat. Tracking Altcoin Gains and Returns. Over the past year, the public attention on cryptocurrencies like Bitcoin has brought a diverse range of people together in one sector: Inquiry about this article. For example, one might try to profit by watching a pair of tightly correlated cryptocurrencies, waiting for one of them to have paper bitcoin exchange wallet claim bitcoin cash via paper wallet disproportionately low price, and then buying that disproportionately cheap cryptocurrency, with the expectation that its price will rise and restore the correlation between the pair. Terms of Use. Buyers are free to set their BID price at their discretion, but if the price strays too far from the market norms, the BID price may need to be adjusted to be useful.