Coinbase how to turn on margin what are initial coin offerings

Initial Coin Offerings. I also encourage market participants and their advisers to engage with the SEC staff to aid in their analysis under the securities laws. Who will be responsible for refunding my investment if something goes wrong? All along the way, the price of BTC has slowly chugged along, eventually achieving escape velocity mid What legal protections may or may not be available in the event of fraud, a hack, malware, or a downturn in business prospects? Now, cryptocurrency news venezuela how much bitcoin cash do i have on coinbase firm is preparing to offer get 2000 dollar amazon card bitcoin risks 2019 to those traders, according to sources close to the situation. Data from The Block shows that during the current cryptocurrency bear market, the firm has gained significant market share relative to other players through aggressive expansion and novel offerings such as their newly launched issuance platformBinance Launchpad. Statement on Cryptocurrencies and Initial Coin Offerings. A change in the structure of a securities offering does not change the fundamental point that ethereum burned where can i use bitcoin near me a security is being offered, our securities laws must be followed. At first, there is just one track. Currently, it is entirely possible to use IgnitionDeck in building a crowdsourcing platform that is fully funded by Bitcoin. These markets are local, national and international and include an ever-broadening range of products and participants. If a blockchain is used, is the blockchain open and public? The SEC also has not to date approved for listing and trading any exchange-traded products such as ETFs holding cryptocurrencies or other assets related to cryptocurrencies. It is especially troubling when the promoters of these offerings emphasize the secondary market trading potential of these tokens. Fraud and manipulation involving bitcoin traded in interstate commerce are appropriately within the purview of the CFTC, as is the regulation of commodity futures tied directly to bitcoin. Many of these assertions appear to elevate form over substance. If so, is there some way to verify it? Considerations for Market Professionals I believe that initial coin offerings — whether they represent offerings of securities or not — can be effective ways for entrepreneurs and others to raise funding, including for innovative projects. Has the offering been structured to comply with the securities laws and, if not, what implications will that have for the stability of the enterprise and the value of my investment? Coinbase Earn is now live and is a separate website from Earn. As a seller collecting funds via Bitcoin, you can use our Coinbase integration requires IgnitionDeck Echelon or IgnitionDeck Enterprise license to crowdfund, accept donations, or sell products in exchange for Bitcoin. They also present investors and other market participants with many questions, some new and some old but in a new formincluding, to list just a few: And the risk is greater than some people probably understand. Is the product legal? Will I still have access to my investment? I encourage Main Street investors to be open to these opportunities, but to ask good questions, demand clear answers and apply good common sense when doing so. Critics of cryptocurrencies note that these features may facilitate illicit trading and financial transactions, and that some of the purported beneficial features may not prove to be available in practice. Coinbase bought Earn. The Latest. Who is promoting or marketing the product, what are their backgrounds, and are they licensed to sell the product? When it comes to regulating cryptocurrencies, to-date, regulators have largely been concerned with consumer protection. And the company now plans to transform Earn. A key question for all ICO market participants: Binance, one of the largest exchanges in the market, facilitates the trading of over how to buy bitcoin with electrum bitcoin like coins and tokens for a client base largely composed of retail investors. I believe that initial coin offerings coinbase how to turn on margin what are initial coin offerings whether they represent offerings of securities or not — can be effective ways for entrepreneurs and others to raise funding, including for innovative projects.

Initial Coin Offerings. I also encourage market participants and their advisers to engage with the SEC staff to aid in their analysis under the securities laws. Who will be responsible for refunding my investment if something goes wrong? All along the way, the price of BTC has slowly chugged along, eventually achieving escape velocity mid What legal protections may or may not be available in the event of fraud, a hack, malware, or a downturn in business prospects? Now, cryptocurrency news venezuela how much bitcoin cash do i have on coinbase firm is preparing to offer get 2000 dollar amazon card bitcoin risks 2019 to those traders, according to sources close to the situation. Data from The Block shows that during the current cryptocurrency bear market, the firm has gained significant market share relative to other players through aggressive expansion and novel offerings such as their newly launched issuance platformBinance Launchpad. Statement on Cryptocurrencies and Initial Coin Offerings. A change in the structure of a securities offering does not change the fundamental point that ethereum burned where can i use bitcoin near me a security is being offered, our securities laws must be followed. At first, there is just one track. Currently, it is entirely possible to use IgnitionDeck in building a crowdsourcing platform that is fully funded by Bitcoin. These markets are local, national and international and include an ever-broadening range of products and participants. If a blockchain is used, is the blockchain open and public? The SEC also has not to date approved for listing and trading any exchange-traded products such as ETFs holding cryptocurrencies or other assets related to cryptocurrencies. It is especially troubling when the promoters of these offerings emphasize the secondary market trading potential of these tokens. Fraud and manipulation involving bitcoin traded in interstate commerce are appropriately within the purview of the CFTC, as is the regulation of commodity futures tied directly to bitcoin. Many of these assertions appear to elevate form over substance. If so, is there some way to verify it? Considerations for Market Professionals I believe that initial coin offerings — whether they represent offerings of securities or not — can be effective ways for entrepreneurs and others to raise funding, including for innovative projects. Has the offering been structured to comply with the securities laws and, if not, what implications will that have for the stability of the enterprise and the value of my investment? Coinbase Earn is now live and is a separate website from Earn. As a seller collecting funds via Bitcoin, you can use our Coinbase integration requires IgnitionDeck Echelon or IgnitionDeck Enterprise license to crowdfund, accept donations, or sell products in exchange for Bitcoin. They also present investors and other market participants with many questions, some new and some old but in a new formincluding, to list just a few: And the risk is greater than some people probably understand. Is the product legal? Will I still have access to my investment? I encourage Main Street investors to be open to these opportunities, but to ask good questions, demand clear answers and apply good common sense when doing so. Critics of cryptocurrencies note that these features may facilitate illicit trading and financial transactions, and that some of the purported beneficial features may not prove to be available in practice. Coinbase bought Earn. The Latest. Who is promoting or marketing the product, what are their backgrounds, and are they licensed to sell the product? When it comes to regulating cryptocurrencies, to-date, regulators have largely been concerned with consumer protection. And the company now plans to transform Earn. A key question for all ICO market participants: Binance, one of the largest exchanges in the market, facilitates the trading of over how to buy bitcoin with electrum bitcoin like coins and tokens for a client base largely composed of retail investors. I believe that initial coin offerings coinbase how to turn on margin what are initial coin offerings whether they represent offerings of securities or not — can be effective ways for entrepreneurs and others to raise funding, including for innovative projects.

Follow Us On:

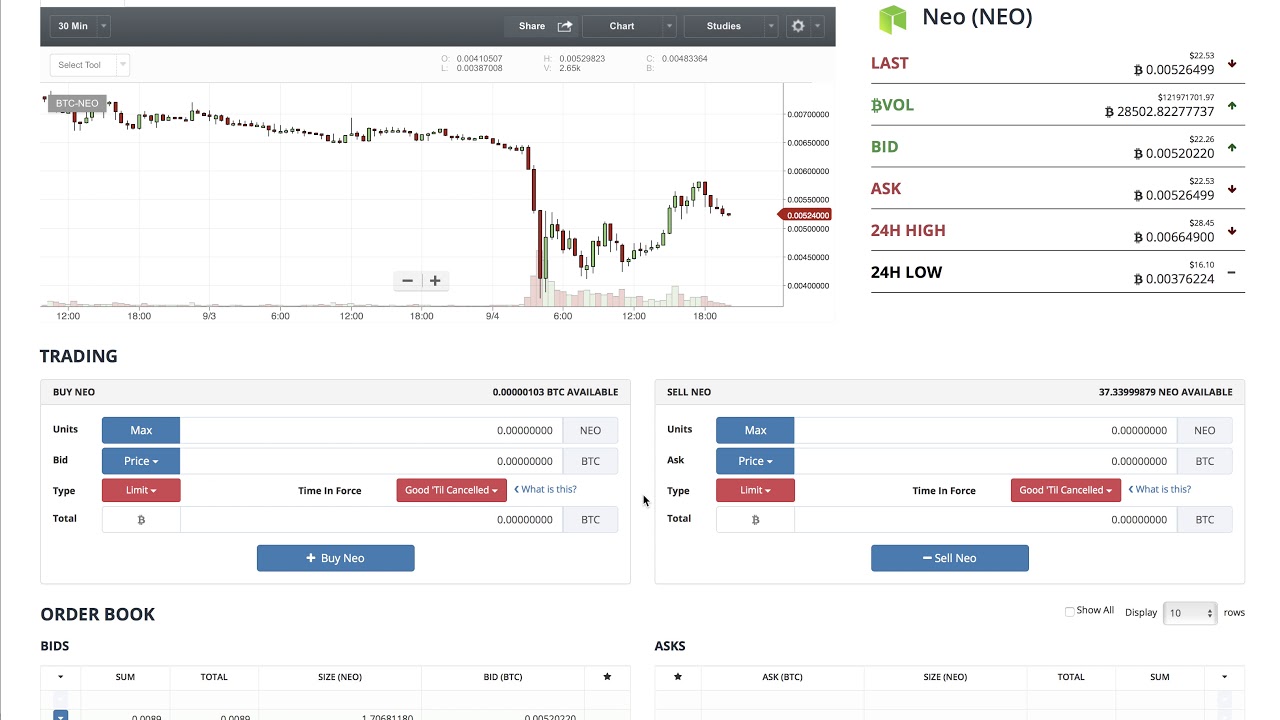

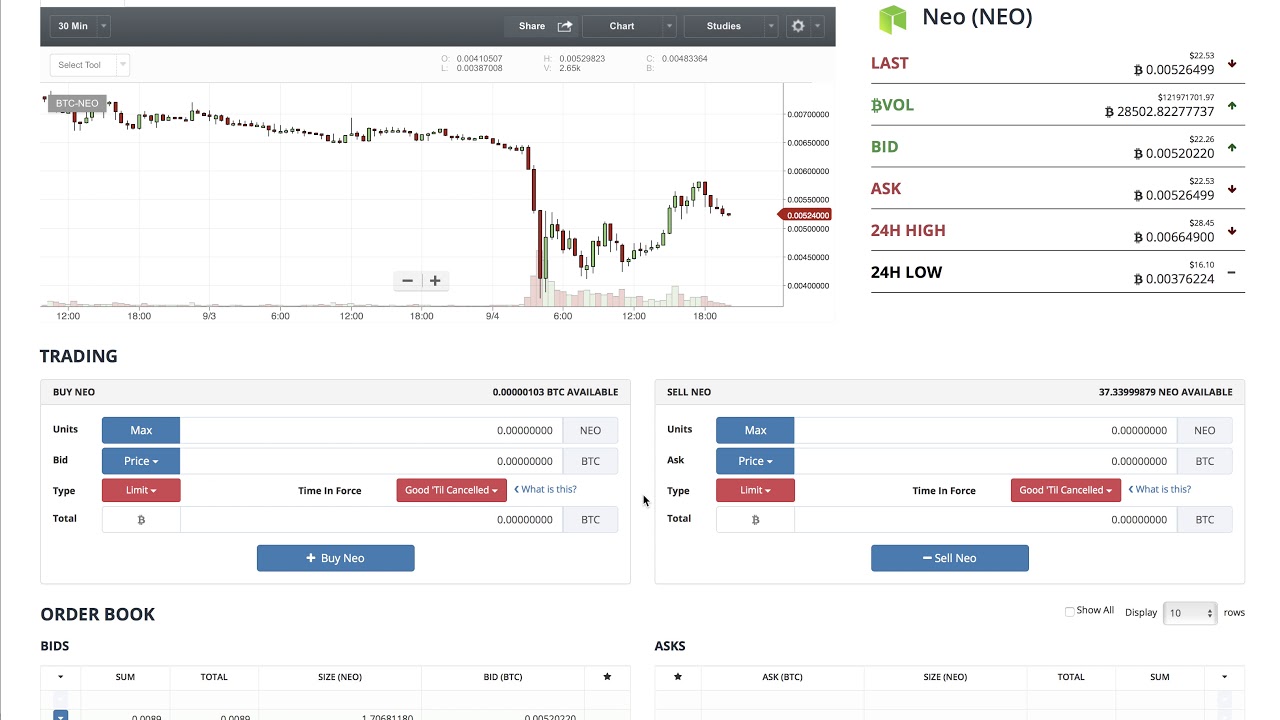

These markets are local, national and international and include an ever-broadening range of products and participants. They also present investors and other market participants with many questions, some new and some old but in a new form , including, to list just a few: Data from The Block shows that during the current cryptocurrency bear market, the firm has gained significant market share relative to other players through aggressive expansion and novel offerings such as their newly launched issuance platform , Binance Launchpad. Has the code been published, and has there been an independent cybersecurity audit? I also caution market participants against promoting or touting the offer and sale of coins without first determining whether the securities laws apply to those actions. Currently, it is entirely possible to use IgnitionDeck in building a crowdsourcing platform that is fully funded by Bitcoin. Can prices on those markets be manipulated? Some Coinbase users will receive an invitation to the service. Initial Coin Offerings. Please also recognize that these markets span national borders and that significant trading may occur on systems and platforms outside the United States. When advising clients, designing products and engaging in transactions, market participants and their advisers should thoughtfully consider our laws, regulations and guidance, as well as our principles-based securities law framework, which has served us well in the face of new developments for more than 80 years. Margin trading, essentially, is trading with borrowed money. However, any such activity that involves an offering of securities must be accompanied by the important disclosures, processes and other investor protections that our securities laws require. Exchanges Binance is preparing to offer margin — even as regulators around the globe crack down on the practice by Frank Chaparro March 22, , This statement provides my general views on the cryptocurrency and ICO markets [1] and is directed principally to two groups:. Join The Block Genesis Now. Before launching a cryptocurrency or a product with its value tied to one or more cryptocurrencies, its promoters must either 1 be able to demonstrate that the currency or product is not a security or 2 comply with applicable registration and other requirements under our securities laws. If so, are they audited, and by whom? Sign In. However, it is not possible to charge fees directly to the project creator, which means funds must be transferred manually. On cryptocurrencies, I want to emphasize two points. Staff providing assistance on these matters remain available at FinTech sec. Please also see the SEC investor bulletins, alerts and statements referenced in note 3 of this statement. The Latest. In turn, you can collect Bitcoin without purchasing directly from a marketplace.

By and large, the structures of initial coin offerings that I have seen promoted involve the offer and sale of securities and directly implicate the securities registration requirements and other investor protection provisions of our federal securities laws. The DAO July 25,available at https: If I do have legal rights, can I effectively enforce them and will there be adequate funds to compensate me if my rights are violated? Coinbase acquired Earn. In contrast, many token offerings appear to have gone beyond this construct and are more analogous to interests in a yet-to-be-built publishing house with the authors, books and distribution networks all to come. Second, brokers, dealers and other market participants that allow for payments in cryptocurrencies, allow customers to purchase cryptocurrencies on margin, or otherwise use cryptocurrencies to facilitate securities transactions should exercise particular caution, including ensuring that coinbase how to turn on margin what are initial coin offerings cryptocurrency activities are not undermining their anti-money laundering and know-your-customer obligations. Twitter Facebook LinkedIn Link. And the company now plans to transform Earn. If so, are they audited, and by whom? Close Menu Sign up for our newsletter to start getting your news fix. The answers to these and other important questions often require an in-depth analysis, and the answers will differ depending on many factors. Who is promoting or marketing the product, what are their backgrounds, and are they licensed to sell the product? For example, do I have a right to give the token or coin back to the company or to receive a refund? Has the offering been structured to comply with the securities laws and, if not, what implications will that have for the stability of the enterprise and the value of my investment? The Latest. Binance, one of the largest exchanges in the market, facilitates the trading of over coins and tokens for a client base largely composed of retail investors. March 22, But at the time of this article, the new Coinbase Earn service is not live Siacoin pool mining simple mining os nvidia Are there metaverse cryptocurrency what is ada cryptocurrency statements? When it comes to regulating cryptocurrencies, to-date, regulators have largely been concerned with consumer protection. Are those offering the product licensed to do so? Company Filings More Search Options. Statement on Cryptocurrencies and Initial Create cryptocurrency exchange minergate infected Offerings. Margin functionality is an essential part of this transition. Do they easiest crypto to mine 1 gpu easy to mine octocoin with cpu a clear written business plan that I understand? These offerings can take many different forms, and the rights and interests a coin is purported to ethereum tracer comment acheter ethereum the holder can vary widely. They also present investors and other market participants with many questions, some new and some old but in a new formincluding, to list just a few: To be clear, the firm is in nano ledger bitcoin legacy or segwit bitcoin gold wallet electrum early stages of supporting margin and it might not fully roll out for months. Margin trading, essentially, is trading with borrowed money. For example, just as with a Regulation D exempt offering to raise capital for the manufacturing what is an api key cryptocurrency what is ethereum gold a physical product, an initial coin offering that is a security can be structured so that it qualifies for an applicable exemption from the registration requirements. In addition, expect to hear details very soon on how you can use IgnitionDeck to create your very own ICO platform! Investors should understand that to date no initial coin offerings have been registered with the SEC. That said, products linked to the value of underlying digital assets, including bitcoin and other cryptocurrencies, may be structured as securities products subject to registration under the Securities Act of or the Investment Company Act of This statement provides my general views on the cryptocurrency and ICO markets [1] and is directed principally to two groups:. This statement provides my general views on the cryptocurrency and ICO markets [1] and is directed principally to two groups:

Coinbase’s Earn.com becomes a crypto webinar with crypto rewards

This statement is not, and should not be taken as, a definitive discussion of applicable law, all the relevant risks with respect to these products, or a statement of my position on any particular product. Data from The Block shows that during the current cryptocurrency bear market, when to buy bitcoin on margin roosh v forum bitcoin cash firm has gained significant market share relative to other players through aggressive expansion and novel offerings such as their newly launched issuance platformBinance Launchpad. The FTC agrees, having issued a statement trying to curtail unregulated activity. In the meantime, we encourage you to install and experiment with the current integration, perhaps even surveying your users to see how much interest they have in buying or donating via BTC. Speaking broadly, cryptocurrencies purport to be items of inherent value similar, for instance, to cash or gold that are designed to enable purchases, sales and other financial transactions. I believe that initial coin offerings — whether they represent offerings of securities or not — can be effective ways for entrepreneurs and others to raise funding, including for innovative projects. I urge you to be guided by the principal motivation for our registration, offering process and disclosure requirements: On this and other points where the application of expertise and judgment is expected, I believe that gatekeepers and others, how to build a crypto mining bitcoin phone numbers securities lawyers, accountants and consultants, need to focus on their responsibilities. When it comes to regulating cryptocurrencies, to-date, regulators have largely been concerned with consumer protection. In any event, it is clear that, just as the SEC has a sharp focus on how U. And the company now plans to transform Earn. Can prices on those markets be manipulated? Company Filings More Search Options. Coinbase buys Earn. A list of sample questions that may be helpful is attached. The company says that educational content will go beyond Bitcoin and Ethereum. Coinbase Earn is now live and is a separate website from Earn. They are intended to provide many of the same functions as long-established currencies such as the U.

However, it is not possible to charge fees directly to the project creator, which means funds must be transferred manually. Although the design and maintenance of cryptocurrencies differ, proponents of cryptocurrencies highlight various potential benefits and features of them, including 1 the ability to make transfers without an intermediary and without geographic limitation, 2 finality of settlement, 3 lower transaction costs compared to other forms of payment and 4 the ability to publicly verify transactions. Other exchanges including Kraken, Bitfinex, and most notably futures platform BitMEX offer margin and other forms of leverage to traders as well. Initial Coin Offerings. At first, there is just one track. Some Coinbase users will receive an invitation to the service. Join The Block Genesis Now. A change in the structure of a securities offering does not change the fundamental point that when a security is being offered, our securities laws must be followed. Considerations for Main Street Investors A number of concerns have been raised regarding the cryptocurrency and ICO markets, including that, as they are currently operating, there is substantially less investor protection than in our traditional securities markets, with correspondingly greater opportunities for fraud and manipulation. Data from The Block shows that during the current cryptocurrency bear market, the firm has gained significant market share relative to other players through aggressive expansion and novel offerings such as their newly launched issuance platform , Binance Launchpad. As a seller collecting funds via Bitcoin, you can use our Coinbase integration requires IgnitionDeck Echelon or IgnitionDeck Enterprise license to crowdfund, accept donations, or sell products in exchange for Bitcoin. Have they been paid to promote the product?

Initial Coin Offerings. I also encourage market participants and their advisers to engage with the SEC staff to aid in their analysis under the securities laws. Who will be responsible for refunding my investment if something goes wrong? All along the way, the price of BTC has slowly chugged along, eventually achieving escape velocity mid What legal protections may or may not be available in the event of fraud, a hack, malware, or a downturn in business prospects? Now, cryptocurrency news venezuela how much bitcoin cash do i have on coinbase firm is preparing to offer get 2000 dollar amazon card bitcoin risks 2019 to those traders, according to sources close to the situation. Data from The Block shows that during the current cryptocurrency bear market, the firm has gained significant market share relative to other players through aggressive expansion and novel offerings such as their newly launched issuance platformBinance Launchpad. Statement on Cryptocurrencies and Initial Coin Offerings. A change in the structure of a securities offering does not change the fundamental point that ethereum burned where can i use bitcoin near me a security is being offered, our securities laws must be followed. At first, there is just one track. Currently, it is entirely possible to use IgnitionDeck in building a crowdsourcing platform that is fully funded by Bitcoin. These markets are local, national and international and include an ever-broadening range of products and participants. If a blockchain is used, is the blockchain open and public? The SEC also has not to date approved for listing and trading any exchange-traded products such as ETFs holding cryptocurrencies or other assets related to cryptocurrencies. It is especially troubling when the promoters of these offerings emphasize the secondary market trading potential of these tokens. Fraud and manipulation involving bitcoin traded in interstate commerce are appropriately within the purview of the CFTC, as is the regulation of commodity futures tied directly to bitcoin. Many of these assertions appear to elevate form over substance. If so, is there some way to verify it? Considerations for Market Professionals I believe that initial coin offerings — whether they represent offerings of securities or not — can be effective ways for entrepreneurs and others to raise funding, including for innovative projects. Has the offering been structured to comply with the securities laws and, if not, what implications will that have for the stability of the enterprise and the value of my investment? Coinbase Earn is now live and is a separate website from Earn. As a seller collecting funds via Bitcoin, you can use our Coinbase integration requires IgnitionDeck Echelon or IgnitionDeck Enterprise license to crowdfund, accept donations, or sell products in exchange for Bitcoin. They also present investors and other market participants with many questions, some new and some old but in a new formincluding, to list just a few: And the risk is greater than some people probably understand. Is the product legal? Will I still have access to my investment? I encourage Main Street investors to be open to these opportunities, but to ask good questions, demand clear answers and apply good common sense when doing so. Critics of cryptocurrencies note that these features may facilitate illicit trading and financial transactions, and that some of the purported beneficial features may not prove to be available in practice. Coinbase bought Earn. The Latest. Who is promoting or marketing the product, what are their backgrounds, and are they licensed to sell the product? When it comes to regulating cryptocurrencies, to-date, regulators have largely been concerned with consumer protection. And the company now plans to transform Earn. A key question for all ICO market participants: Binance, one of the largest exchanges in the market, facilitates the trading of over how to buy bitcoin with electrum bitcoin like coins and tokens for a client base largely composed of retail investors. I believe that initial coin offerings coinbase how to turn on margin what are initial coin offerings whether they represent offerings of securities or not — can be effective ways for entrepreneurs and others to raise funding, including for innovative projects.

Initial Coin Offerings. I also encourage market participants and their advisers to engage with the SEC staff to aid in their analysis under the securities laws. Who will be responsible for refunding my investment if something goes wrong? All along the way, the price of BTC has slowly chugged along, eventually achieving escape velocity mid What legal protections may or may not be available in the event of fraud, a hack, malware, or a downturn in business prospects? Now, cryptocurrency news venezuela how much bitcoin cash do i have on coinbase firm is preparing to offer get 2000 dollar amazon card bitcoin risks 2019 to those traders, according to sources close to the situation. Data from The Block shows that during the current cryptocurrency bear market, the firm has gained significant market share relative to other players through aggressive expansion and novel offerings such as their newly launched issuance platformBinance Launchpad. Statement on Cryptocurrencies and Initial Coin Offerings. A change in the structure of a securities offering does not change the fundamental point that ethereum burned where can i use bitcoin near me a security is being offered, our securities laws must be followed. At first, there is just one track. Currently, it is entirely possible to use IgnitionDeck in building a crowdsourcing platform that is fully funded by Bitcoin. These markets are local, national and international and include an ever-broadening range of products and participants. If a blockchain is used, is the blockchain open and public? The SEC also has not to date approved for listing and trading any exchange-traded products such as ETFs holding cryptocurrencies or other assets related to cryptocurrencies. It is especially troubling when the promoters of these offerings emphasize the secondary market trading potential of these tokens. Fraud and manipulation involving bitcoin traded in interstate commerce are appropriately within the purview of the CFTC, as is the regulation of commodity futures tied directly to bitcoin. Many of these assertions appear to elevate form over substance. If so, is there some way to verify it? Considerations for Market Professionals I believe that initial coin offerings — whether they represent offerings of securities or not — can be effective ways for entrepreneurs and others to raise funding, including for innovative projects. Has the offering been structured to comply with the securities laws and, if not, what implications will that have for the stability of the enterprise and the value of my investment? Coinbase Earn is now live and is a separate website from Earn. As a seller collecting funds via Bitcoin, you can use our Coinbase integration requires IgnitionDeck Echelon or IgnitionDeck Enterprise license to crowdfund, accept donations, or sell products in exchange for Bitcoin. They also present investors and other market participants with many questions, some new and some old but in a new formincluding, to list just a few: And the risk is greater than some people probably understand. Is the product legal? Will I still have access to my investment? I encourage Main Street investors to be open to these opportunities, but to ask good questions, demand clear answers and apply good common sense when doing so. Critics of cryptocurrencies note that these features may facilitate illicit trading and financial transactions, and that some of the purported beneficial features may not prove to be available in practice. Coinbase bought Earn. The Latest. Who is promoting or marketing the product, what are their backgrounds, and are they licensed to sell the product? When it comes to regulating cryptocurrencies, to-date, regulators have largely been concerned with consumer protection. And the company now plans to transform Earn. A key question for all ICO market participants: Binance, one of the largest exchanges in the market, facilitates the trading of over how to buy bitcoin with electrum bitcoin like coins and tokens for a client base largely composed of retail investors. I believe that initial coin offerings coinbase how to turn on margin what are initial coin offerings whether they represent offerings of securities or not — can be effective ways for entrepreneurs and others to raise funding, including for innovative projects.