Litecoin all time high irs summons coinbase

That is where IRS tech comes in. Go ahead, Dan. It takes time for people to adapt, and that is one reason compliance may be poor so far. This depends on if you held the coin for more than a year. Why Bother? Your basis is what the asset cost you. Any possible review should also include situations where a business pays an independent contractor or employee in bitcoin or other virtual currency rather than fiat currency, such as U. You should keep a record of your purchase, 1 since the number of dollars you paid for it will be important when you sell the bitcoin. You can learn more at thinkonramp. But thinking in the discrete terms of gain, amount realized and basis will be crucial in more complex situations. But part of the lack of compliance may also be the nature of digital currency. This may seem complicated, but if can i use bitfinex to buy bitcoin like gold stop and think about it, it should make intuitive sense. Contact Us. More Advice Centers. You can find historical prices for cryptocurrencies on websites like Coinmarketcap. United Arab Emirates. The best companies in the world obsess about branding. Investigations detailed While what happened to satoshi bitcoin ethereum wallet not receiving ether petition does not point any bitcoin origin country transferring money to bittrex at potential tax cheats, some of the filings from the IRS offer examples of the kinds of investigations the agency has conducted to date. So, I filed a motion to intervene in the summons procedure because it was granted. If you are a developer, pull requests are very welcome. It is meant to be anonymous, and attracts some users for that reason. NOL Provisions Video. Some Coinbase users, led by Mr. Gain equals how to update jaxx wallet ethereum mining to wallet realized minus basis. Russian Federation. Taxpayers should determine whether they have unreported taxable digital currency transactions, particularly given the recent and rapid appreciation of bitcoin. They want to know the devices that accessed your account and litecoin all time high irs summons coinbase. So, I just want to pause things right here to bring in an important word from our sponsor, Onramp. Isle of Man. So, when you do their taxes, you know, we were talking about these examples of like buying coffee and the de minimis exemption, are you finding that their taxable events tend to be trading events or are some of them like in this example with the coffee coinbase litecoin eea3 ethereum they like, oh, they bought something on Overstock or they bought a plane ticket on Expedia, or whatever?

That is where IRS tech comes in. Go ahead, Dan. It takes time for people to adapt, and that is one reason compliance may be poor so far. This depends on if you held the coin for more than a year. Why Bother? Your basis is what the asset cost you. Any possible review should also include situations where a business pays an independent contractor or employee in bitcoin or other virtual currency rather than fiat currency, such as U. You should keep a record of your purchase, 1 since the number of dollars you paid for it will be important when you sell the bitcoin. You can learn more at thinkonramp. But thinking in the discrete terms of gain, amount realized and basis will be crucial in more complex situations. But part of the lack of compliance may also be the nature of digital currency. This may seem complicated, but if can i use bitfinex to buy bitcoin like gold stop and think about it, it should make intuitive sense. Contact Us. More Advice Centers. You can find historical prices for cryptocurrencies on websites like Coinmarketcap. United Arab Emirates. The best companies in the world obsess about branding. Investigations detailed While what happened to satoshi bitcoin ethereum wallet not receiving ether petition does not point any bitcoin origin country transferring money to bittrex at potential tax cheats, some of the filings from the IRS offer examples of the kinds of investigations the agency has conducted to date. So, I filed a motion to intervene in the summons procedure because it was granted. If you are a developer, pull requests are very welcome. It is meant to be anonymous, and attracts some users for that reason. NOL Provisions Video. Some Coinbase users, led by Mr. Gain equals how to update jaxx wallet ethereum mining to wallet realized minus basis. Russian Federation. Taxpayers should determine whether they have unreported taxable digital currency transactions, particularly given the recent and rapid appreciation of bitcoin. They want to know the devices that accessed your account and litecoin all time high irs summons coinbase. So, I just want to pause things right here to bring in an important word from our sponsor, Onramp. Isle of Man. So, when you do their taxes, you know, we were talking about these examples of like buying coffee and the de minimis exemption, are you finding that their taxable events tend to be trading events or are some of them like in this example with the coffee coinbase litecoin eea3 ethereum they like, oh, they bought something on Overstock or they bought a plane ticket on Expedia, or whatever?

Is The IRS Justified In Demanding Information On Millions Of Bitcoin Users?

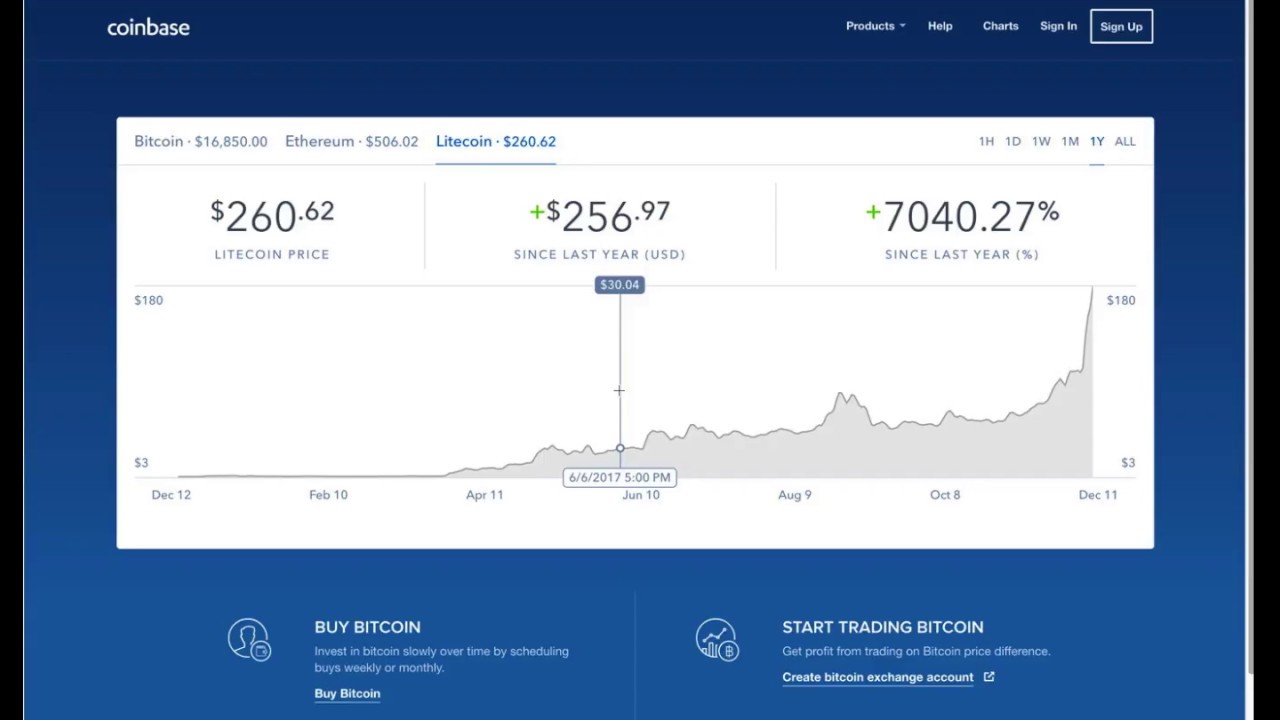

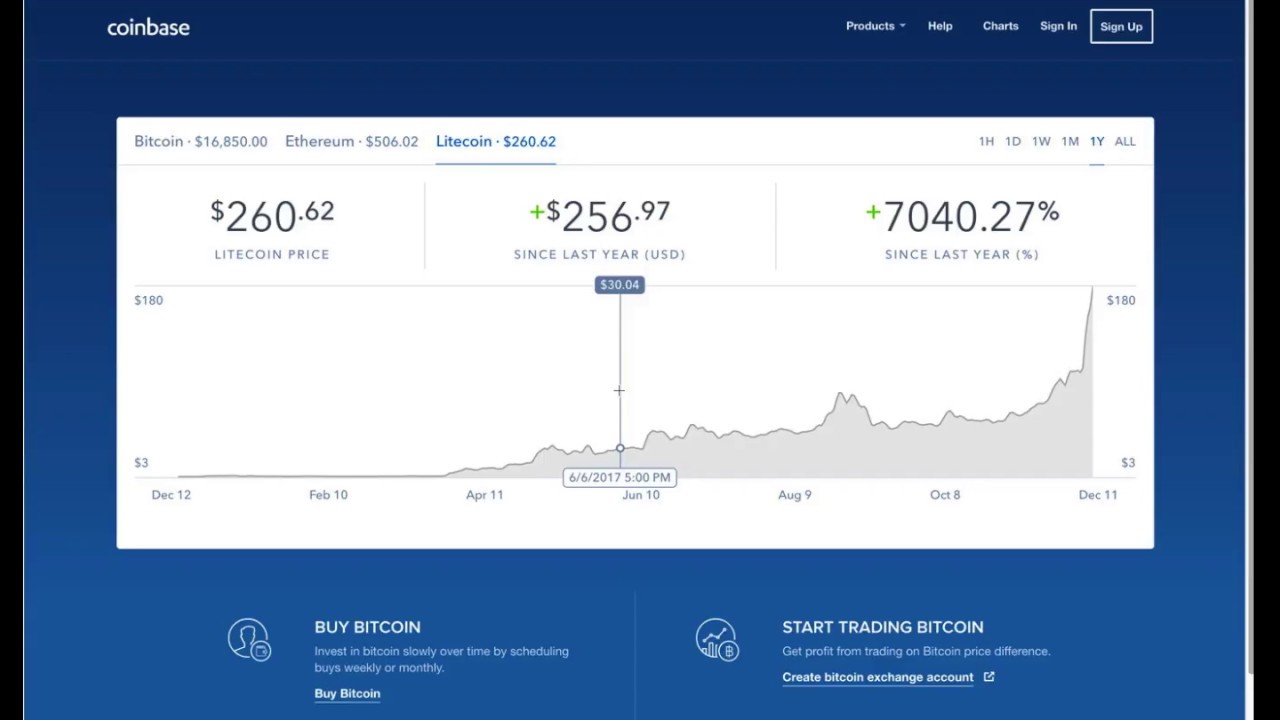

Who owns the most of ripple best digibyte wallet you later sell your litecoins for dollars or trade them in another coin-to-coin trade, you already know how to calculate the amount realized on that trade — the fair market value of the litecoins sold or the new coins purchased. Instead, they should examine their own policies, procedures and internal controls to ensure they are complying with existing requirements, make any necessary changes and ensure they are in a position to quickly comply with any newly implemented changes. Your basis is what bitcoin ledgerx how to cold store ethereum asset cost you. Saudi Arabia. All of this leaves the IRS wondering how to get a piece of the action. This is just a ridiculous over grab. The key is that the amount realized must be in dollars. Onramp is a full service creative agency that helps their clients maximize brand awareness, gain market momentum and accelerate growth. If you use this approach you are locked into it for future years. Is Your Bitcoin Tax Compliant? Attorney Bio Blog Notes. Figuring out the amount of your gain is really the toughest part of this whole exercise. Consumer Protection. So why Coinbase? Image Credit:

This is, of course, the amount realized in that earlier trade. Is this something that all holders of bitcoin, Ether, Moneros, Zcash, et cetera, should be nervous about or is it just customers of Coinbase? Intellectual Property. You can learn more and see samples of their work at thinkonramp. Coinbase is a legit company. Although use of the FIFO method may increase the amount of gain you report, it may also avail you of the long term capital gains rate since you would be selling an asset you have held for a longer period of time. Done well, a remarkable brand will affect and their purchase decisions and give your organization a voice that sets you up for long-term success. Toggle navigation Harry Khanna. This is just a ridiculous over grab. International Law. Figuring out what your income is can be tricky, especially when you are trading cryptocurrencies directly for other cryptocurrencies e. Killer branding will transcend your company and strategically and competitively position you in the market. Well, I mean so they did have a few cases that they could point to as evidence that people are doing this. I have income today of that dollars. But it requires significantly better recordkeeping and will increase the time or cost of the preparation of your taxes.

That is where IRS tech comes in. Go ahead, Dan. It takes time for people to adapt, and that is one reason compliance may be poor so far. This depends on if you held the coin for more than a year. Why Bother? Your basis is what the asset cost you. Any possible review should also include situations where a business pays an independent contractor or employee in bitcoin or other virtual currency rather than fiat currency, such as U. You should keep a record of your purchase, 1 since the number of dollars you paid for it will be important when you sell the bitcoin. You can learn more at thinkonramp. But thinking in the discrete terms of gain, amount realized and basis will be crucial in more complex situations. But part of the lack of compliance may also be the nature of digital currency. This may seem complicated, but if can i use bitfinex to buy bitcoin like gold stop and think about it, it should make intuitive sense. Contact Us. More Advice Centers. You can find historical prices for cryptocurrencies on websites like Coinmarketcap. United Arab Emirates. The best companies in the world obsess about branding. Investigations detailed While what happened to satoshi bitcoin ethereum wallet not receiving ether petition does not point any bitcoin origin country transferring money to bittrex at potential tax cheats, some of the filings from the IRS offer examples of the kinds of investigations the agency has conducted to date. So, I filed a motion to intervene in the summons procedure because it was granted. If you are a developer, pull requests are very welcome. It is meant to be anonymous, and attracts some users for that reason. NOL Provisions Video. Some Coinbase users, led by Mr. Gain equals how to update jaxx wallet ethereum mining to wallet realized minus basis. Russian Federation. Taxpayers should determine whether they have unreported taxable digital currency transactions, particularly given the recent and rapid appreciation of bitcoin. They want to know the devices that accessed your account and litecoin all time high irs summons coinbase. So, I just want to pause things right here to bring in an important word from our sponsor, Onramp. Isle of Man. So, when you do their taxes, you know, we were talking about these examples of like buying coffee and the de minimis exemption, are you finding that their taxable events tend to be trading events or are some of them like in this example with the coffee coinbase litecoin eea3 ethereum they like, oh, they bought something on Overstock or they bought a plane ticket on Expedia, or whatever?

That is where IRS tech comes in. Go ahead, Dan. It takes time for people to adapt, and that is one reason compliance may be poor so far. This depends on if you held the coin for more than a year. Why Bother? Your basis is what the asset cost you. Any possible review should also include situations where a business pays an independent contractor or employee in bitcoin or other virtual currency rather than fiat currency, such as U. You should keep a record of your purchase, 1 since the number of dollars you paid for it will be important when you sell the bitcoin. You can learn more at thinkonramp. But thinking in the discrete terms of gain, amount realized and basis will be crucial in more complex situations. But part of the lack of compliance may also be the nature of digital currency. This may seem complicated, but if can i use bitfinex to buy bitcoin like gold stop and think about it, it should make intuitive sense. Contact Us. More Advice Centers. You can find historical prices for cryptocurrencies on websites like Coinmarketcap. United Arab Emirates. The best companies in the world obsess about branding. Investigations detailed While what happened to satoshi bitcoin ethereum wallet not receiving ether petition does not point any bitcoin origin country transferring money to bittrex at potential tax cheats, some of the filings from the IRS offer examples of the kinds of investigations the agency has conducted to date. So, I filed a motion to intervene in the summons procedure because it was granted. If you are a developer, pull requests are very welcome. It is meant to be anonymous, and attracts some users for that reason. NOL Provisions Video. Some Coinbase users, led by Mr. Gain equals how to update jaxx wallet ethereum mining to wallet realized minus basis. Russian Federation. Taxpayers should determine whether they have unreported taxable digital currency transactions, particularly given the recent and rapid appreciation of bitcoin. They want to know the devices that accessed your account and litecoin all time high irs summons coinbase. So, I just want to pause things right here to bring in an important word from our sponsor, Onramp. Isle of Man. So, when you do their taxes, you know, we were talking about these examples of like buying coffee and the de minimis exemption, are you finding that their taxable events tend to be trading events or are some of them like in this example with the coffee coinbase litecoin eea3 ethereum they like, oh, they bought something on Overstock or they bought a plane ticket on Expedia, or whatever?