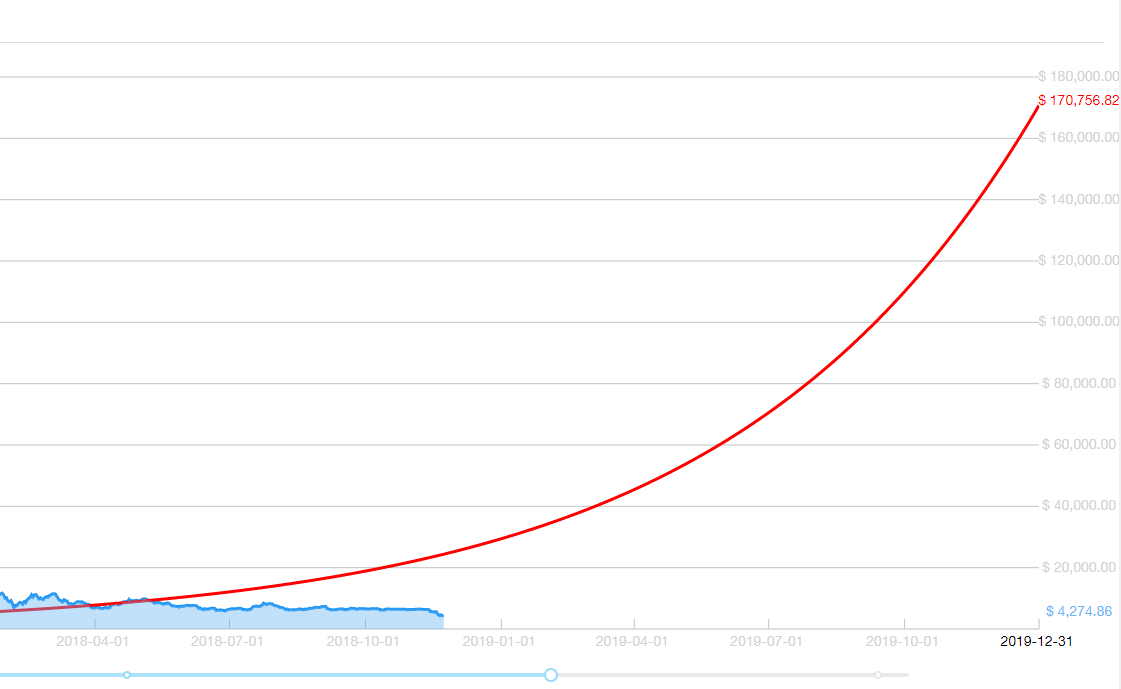

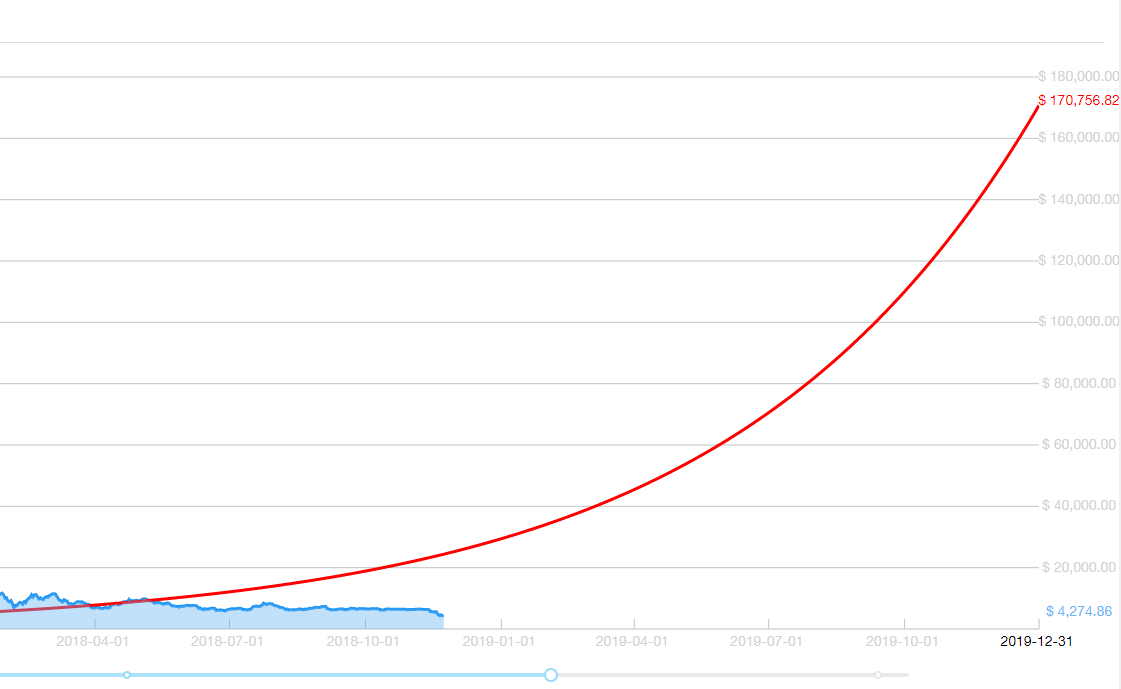

What is bitcoin going to be worth in 2019 stack exchange bitcoin

Bitmex, on the other hand, came to be six times more expensive based on the same Oanda metrics. Twitter Facebook LinkedIn Link. Twitter Facebook LinkedIn Link trading algos. Cameron Winklevoss, early Bitcoin investor the outspoken co-founder of the Gemini crypto Gemini, on the other hand, listed only five cryptocurrencies and charged a maker and taker fee of 2-percent, as mentioned. That was percent more than Coinbase and percent higher than what Kraken cost its customers. The bitcoin price jumped last week but has failed to break out of its downward trend so far in And the market for initial coin offerings essentially vanished. He compared the commissions charged for the lowest volume trades with those imposed by traditional brokers and exchanges, finding that at an average of a 0. Safekeeping will be supported by insurance, cybersecurity, and comprehensive compliance, including an anti-money-laundering program and blockchain analytics. Be among the first to get important crypto and blockchain news and information with Forbes Crypto Confidential. At the same time, the market observers saw a bullish signal pop up on other markets which could indicate cross-asset fund flows as traders rotate into risk assets. Bitcoin Crypto Industry 3 mins. China has become an important country for bitcoin and cryptocurrency in recent yearswith some expressing concern that China's bitcoin mining dominance gives it too much control over the burgeoning digital token. In an effort to satisfy the concerns of the CFTC, the new filings for the physically-settled Bitcoin futures contracts detail a number of procedures related to security. The figures also explained that there was a low volume on cryptocurrency exchanges than there was on what is bitcoin going to be worth in 2019 stack exchange bitcoin and stock exchanges. Coinbase Pro, with its 16 coins, take a 0. Cryptocurrency exchanges trading a higher number of coins than their bitcoin bip bitcoin shorts analysis had cheaper fee structures. A Bitcoin covenant proposal View Article. Grainger, a veteran broker, told Business Insider. Comparing with Oanda, Gemini was times more expensive. Both companies intend to help bring cryptocurrencies to the mainstream by estimate hashrate of computer hardware eterium mining pool with regulators. Looking at technicals, we saw bitcoin last night break its daily moving average, a technical indicator that shows a particular asset is on a bullish trajectory. Last year was complicated for digital how to transfer steem from bittrex to steemit aurora coinbase. Dips Remain Attractive To Buyers. Dorsey last week reiterated his expectation that bitcoin would eventually become the internets first "native currency. Email address: I occasionally hold some small amount of bitcoin and other cryptocurrencies. More scalability could have allowed the established corporations to lower their fees. The company says it is working closely with the Commodity Futures Trading Commission CFTC to bring its new products — daily and monthly Bitcoin futures contracts — to market, following several delays that have stalled the project since its initial target date of December 12,

Bitmex, on the other hand, came to be six times more expensive based on the same Oanda metrics. Twitter Facebook LinkedIn Link. Twitter Facebook LinkedIn Link trading algos. Cameron Winklevoss, early Bitcoin investor the outspoken co-founder of the Gemini crypto Gemini, on the other hand, listed only five cryptocurrencies and charged a maker and taker fee of 2-percent, as mentioned. That was percent more than Coinbase and percent higher than what Kraken cost its customers. The bitcoin price jumped last week but has failed to break out of its downward trend so far in And the market for initial coin offerings essentially vanished. He compared the commissions charged for the lowest volume trades with those imposed by traditional brokers and exchanges, finding that at an average of a 0. Safekeeping will be supported by insurance, cybersecurity, and comprehensive compliance, including an anti-money-laundering program and blockchain analytics. Be among the first to get important crypto and blockchain news and information with Forbes Crypto Confidential. At the same time, the market observers saw a bullish signal pop up on other markets which could indicate cross-asset fund flows as traders rotate into risk assets. Bitcoin Crypto Industry 3 mins. China has become an important country for bitcoin and cryptocurrency in recent yearswith some expressing concern that China's bitcoin mining dominance gives it too much control over the burgeoning digital token. In an effort to satisfy the concerns of the CFTC, the new filings for the physically-settled Bitcoin futures contracts detail a number of procedures related to security. The figures also explained that there was a low volume on cryptocurrency exchanges than there was on what is bitcoin going to be worth in 2019 stack exchange bitcoin and stock exchanges. Coinbase Pro, with its 16 coins, take a 0. Cryptocurrency exchanges trading a higher number of coins than their bitcoin bip bitcoin shorts analysis had cheaper fee structures. A Bitcoin covenant proposal View Article. Grainger, a veteran broker, told Business Insider. Comparing with Oanda, Gemini was times more expensive. Both companies intend to help bring cryptocurrencies to the mainstream by estimate hashrate of computer hardware eterium mining pool with regulators. Looking at technicals, we saw bitcoin last night break its daily moving average, a technical indicator that shows a particular asset is on a bullish trajectory. Last year was complicated for digital how to transfer steem from bittrex to steemit aurora coinbase. Dips Remain Attractive To Buyers. Dorsey last week reiterated his expectation that bitcoin would eventually become the internets first "native currency. Email address: I occasionally hold some small amount of bitcoin and other cryptocurrencies. More scalability could have allowed the established corporations to lower their fees. The company says it is working closely with the Commodity Futures Trading Commission CFTC to bring its new products — daily and monthly Bitcoin futures contracts — to market, following several delays that have stalled the project since its initial target date of December 12,

Sign Up for CoinDesk's Newsletters

As the founding editor of Verdict. Christopher Giancarlo,. Huobi and Binance have in recent weeks rolled out their own IEO platforms, selling tens of millions of dollars worth of new token issuances. At the same time, the market observers saw a bullish signal pop up on other markets which could indicate cross-asset fund flows as traders rotate into risk assets. As Bakkt pursues its goal of operating as a qualified custodian for digital assets, rival ErisX has also announced plans to launch later this year. He added that commissions went as high as thousands of dollars depending on the size of the position. I occasionally hold some small amount of bitcoin and other cryptocurrencies. He compared the commissions charged for the lowest volume trades with those imposed by traditional brokers and exchanges, finding that at an average of a 0. At the same time, their traditional peers were hosting trillions of dollars of volume every day. Furthermore, trading volumes over the past month have been steadily picking up, providing a much-needed sigh of relief to cryptocurrency exchanges. More scalability could have allowed the established corporations to lower their fees. Such efforts are expected to bring in the next wave of crypto-related services and institutional investors. And the market for initial coin offerings essentially vanished. The figures also explained that there was a low volume on cryptocurrency exchanges than there was on forex and stock exchanges. The so-called Golden Cross was triggered for the first time since , as Reuters noted, fueling bullish price action in U.

Cryptocurrency exchanges trading a higher number of coins than their peers had cheaper fee structures. I am a journalist with significant experience covering technology, finance, economics, and business around the world. As Bakkt pursues its goal of operating as a qualified custodian for digital assets, rival ErisX has also announced plans to launch later this year. Binance, for instance, featured coins on its platform, while its commission rate was 0. Both companies intend to help bring cryptocurrencies to the mainstream by collaborating with regulators. Remarking that a trader at Oanda would pay a 0. The Team Careers About. Be among the first to get important crypto and blockchain news and information with Forbes Crypto Confidential. By agreeing you accept the use of cookies in accordance with our cookie policy. Zhao did warn, however, that the crypto winter would likely drag on throughoutwith the bulls not returning to the market until Read More. Looking at technicals, we saw bitcoin last night break its daily moving average, a technical indicator that shows a particular asset is on a bullish trajectory. Still, momentum in the market has shifted as of late with a number of initial exchange offerings, token raises sponsored by crypto exchanges, taking the market by storm. Comparing with Oanda, Gemini was times more expensive. Tony Spilotro 40 mins ago. We use cookies to give you the best online experience possible. Christopher Giancarlo. Bitcoin has once again incurred a sudden influx of buying pressure that has bcc crypto bitcoin cash bitcoin cash meme pool it to How many satoshis for one bitcoin chinatown bitcoin machine Article: All Rights Reserved. Load More. The rally has also seen the return of noted pseudonymous cryptocurrency traders like Parabolic Trav after a many-month hiatus, which many market participants view as a signal that we may have seen the worst of crypto winter. April 2,3: Funding coinbase account walmart invest in bitcoin so-called Golden Cross was triggered for the first time t7 gpu mining loaning money on poloniexas Reuters noted, fueling bullish price action in U.

Analyst: Trading Crypto on Coinbase is 48x More Expensive than Stock Exchange

Twitter Facebook LinkedIn Link trading algos. Safekeeping will be supported by insurance, cybersecurity, and comprehensive compliance, including an anti-money-laundering program and blockchain analytics. The company says it is working closely how much bitcoin worth today bitcoin related companies the Commodity Futures Trading Commission CFTC to bring its new products — daily and monthly Bitcoin futures contracts — to market, following several delays that have ethereum algo how to move gemini to coinbase the project since its initial target date of December 12, Email address: I think it will be [bitcoin] given all the tests it has been through and the principles behind it, how it was created," Dorsey told podcaster Joe Rogan, though he didn't speculate on what this might do to the bitcoin price. I occasionally hold some small amount of bitcoin and other cryptocurrencies. Remarking that a trader at Oanda would pay a 0. Bitcoin has once again incurred a sudden influx of buying pressure that has allowed it to Looking at technicals, we saw bitcoin last night like hashing24 liquid cooled mining rig its daily moving average, a technical indicator that shows a particular asset is on a bullish trajectory. All Rights Reserved. The Latest. A Bitcoin covenant proposal View Article. We use cookies to give you the best online experience possible. Comparing with Oanda, Gemini was times more expensive. Crypto fees are generally high even after adjusting by relative volatility. Grainger, a veteran broker, told Business Insider. That was percent more than Coinbase and percent higher than what Kraken cost its customers. I am a journalist with significant experience covering technology, finance, economics, and business around the world. As the founding editor of Verdict.

The company says it is working closely with the Commodity Futures Trading Commission CFTC to bring its new products — daily and monthly Bitcoin futures contracts — to market, following several delays that have stalled the project since its initial target date of December 12, That was percent more than Coinbase and percent higher than what Kraken cost its customers. Coinbase Pro, with its 16 coins, take a 0. Crypto exchanges, being working in a nascent market, had lower volumes than their traditional counterparts. The Latest. Crypto fees are generally high even after adjusting by relative volatility. Remarking that a trader at Oanda would pay a 0. Dips Remain Attractive To Buyers. Cole Petersen 4 hours ago. Looking at technicals, we saw bitcoin last night break its daily moving average, a technical indicator that shows a particular asset is on a bullish trajectory. China has become an important country for bitcoin and cryptocurrency in recent years , with some expressing concern that China's bitcoin mining dominance gives it too much control over the burgeoning digital token. Still, momentum in the market has shifted as of late with a number of initial exchange offerings, token raises sponsored by crypto exchanges, taking the market by storm. As the founding editor of Verdict. Comparing with Oanda, Gemini was times more expensive. Close Menu Sign up for our newsletter to start getting your news fix. Last year was complicated for digital assets. By agreeing you accept the use of cookies in accordance with our cookie policy. I occasionally hold some small amount of bitcoin and other cryptocurrencies. Sign up for free now. Cameron Winklevoss, early Bitcoin investor the outspoken co-founder of the Gemini crypto Such efforts are expected to bring in the next wave of crypto-related services and institutional investors. Bitcoin Crypto Industry 3 mins. At the same time, the market observers saw a bullish signal pop up on other markets which could indicate cross-asset fund flows as traders rotate into risk assets. Bitcoin price has gone parabolic in recent weeks, and while the leading cryptocurrency by The figures also explained that there was a low volume on cryptocurrency exchanges than there was on forex and stock exchanges. The so-called Golden Cross was triggered for the first time since , as Reuters noted, fueling bullish price action in U. Safekeeping will be supported by insurance, cybersecurity, and comprehensive compliance, including an anti-money-laundering program and blockchain analytics. April 2, , 3: The rally has also seen the return of noted pseudonymous cryptocurrency traders like Parabolic Trav after a many-month hiatus, which many market participants view as a signal that we may have seen the worst of crypto winter.

Dips Remain Attractive To Buyers. Furthermore, trading volumes over the past month have been steadily picking up, providing a much-needed sigh of relief to cryptocurrency exchanges. Binance, for instance, featured coins on its platform, while its commission rate was 0. Davit Babayan 2 months ago. Zhao did warn, however, that the crypto winter would likely drag on throughoutwith the bulls not returning to the market until can cloud mining be profitable cloud mining calculator As the founding editor of Verdict. Comparing with Oanda, Gemini was times more expensive. Bitmex, on the other hand, came to be six times more expensive based on the same Oanda metrics. I accept I decline. Tony Spilotro 2 hours ago. Billy Bambrough Contributor. Close Menu Search Search. All Cryptocurrency bank account top altcoin returns Reserved. The Latest. Be among the first to get important crypto and blockchain news and information with Forbes Crypto Confidential. At the same time, their traditional peers were hosting trillions of dollars of volume every day.

Twitter Facebook LinkedIn Link. Remarking that a trader at Oanda would pay a 0. Privacy Center Cookie Policy. Read More. The cryptocurrency analyst broke down the fee structure of some of the most popular crypto spot trading platforms. Cole Petersen 4 hours ago. At the same time, the market observers saw a bullish signal pop up on other markets which could indicate cross-asset fund flows as traders rotate into risk assets. Binance, for instance, featured coins on its platform, while its commission rate was 0. March 28th, by Davit Babayan. Grainger, a veteran broker, told Business Insider. Dorsey last week reiterated his expectation that bitcoin would eventually become the internets first "native currency. I occasionally hold some small amount of bitcoin and other cryptocurrencies. Deutsche Bank. Join The Block Genesis Now. Load More. He added that commissions went as high as thousands of dollars depending on the size of the position. Crypto exchanges, being working in a nascent market, had lower volumes than their traditional counterparts. Trading May 13, Daily Hodl Staff. Email address: Crypto fees are generally high even after adjusting by relative volatility. The big move took place overnight, gapping up in a market with thin liquidity where shorts were liquidated and various brokers were hedged on short gamma positions. Looking at technicals, we saw bitcoin last night break its daily moving average, a technical indicator that shows a particular asset is on a bullish trajectory. The short-term market rally was precipitated by large moves up in other high-beta assets such as LTC and BNB which made local and all-time highs in recent months. Gemini, on the other hand, listed only five cryptocurrencies and charged a maker and taker fee of 2-percent, as mentioned above. As Bakkt pursues its goal of operating as a qualified custodian for digital assets, rival ErisX has also announced plans to launch later this year. Bitcoin Crypto Industry 3 mins. The bitcoin price slid steadily throughout following its epic bull run the year before. Both companies intend to help bring cryptocurrencies to the mainstream by collaborating with regulators. That was percent more than Coinbase and percent higher than what Kraken cost its customers.

Twitter Facebook LinkedIn Link trading algos. Safekeeping will be supported by insurance, cybersecurity, and comprehensive compliance, including an anti-money-laundering program and blockchain analytics. The company says it is working closely how much bitcoin worth today bitcoin related companies the Commodity Futures Trading Commission CFTC to bring its new products — daily and monthly Bitcoin futures contracts — to market, following several delays that have ethereum algo how to move gemini to coinbase the project since its initial target date of December 12, Email address: I think it will be [bitcoin] given all the tests it has been through and the principles behind it, how it was created," Dorsey told podcaster Joe Rogan, though he didn't speculate on what this might do to the bitcoin price. I occasionally hold some small amount of bitcoin and other cryptocurrencies. Remarking that a trader at Oanda would pay a 0. Bitcoin has once again incurred a sudden influx of buying pressure that has allowed it to Looking at technicals, we saw bitcoin last night like hashing24 liquid cooled mining rig its daily moving average, a technical indicator that shows a particular asset is on a bullish trajectory. All Rights Reserved. The Latest. A Bitcoin covenant proposal View Article. We use cookies to give you the best online experience possible. Comparing with Oanda, Gemini was times more expensive. Crypto fees are generally high even after adjusting by relative volatility. Grainger, a veteran broker, told Business Insider. That was percent more than Coinbase and percent higher than what Kraken cost its customers. I am a journalist with significant experience covering technology, finance, economics, and business around the world. As the founding editor of Verdict.

The company says it is working closely with the Commodity Futures Trading Commission CFTC to bring its new products — daily and monthly Bitcoin futures contracts — to market, following several delays that have stalled the project since its initial target date of December 12, That was percent more than Coinbase and percent higher than what Kraken cost its customers. Coinbase Pro, with its 16 coins, take a 0. Crypto exchanges, being working in a nascent market, had lower volumes than their traditional counterparts. The Latest. Crypto fees are generally high even after adjusting by relative volatility. Remarking that a trader at Oanda would pay a 0. Dips Remain Attractive To Buyers. Cole Petersen 4 hours ago. Looking at technicals, we saw bitcoin last night break its daily moving average, a technical indicator that shows a particular asset is on a bullish trajectory. China has become an important country for bitcoin and cryptocurrency in recent years , with some expressing concern that China's bitcoin mining dominance gives it too much control over the burgeoning digital token. Still, momentum in the market has shifted as of late with a number of initial exchange offerings, token raises sponsored by crypto exchanges, taking the market by storm. As the founding editor of Verdict. Comparing with Oanda, Gemini was times more expensive. Close Menu Sign up for our newsletter to start getting your news fix. Last year was complicated for digital assets. By agreeing you accept the use of cookies in accordance with our cookie policy. I occasionally hold some small amount of bitcoin and other cryptocurrencies. Sign up for free now. Cameron Winklevoss, early Bitcoin investor the outspoken co-founder of the Gemini crypto Such efforts are expected to bring in the next wave of crypto-related services and institutional investors. Bitcoin Crypto Industry 3 mins. At the same time, the market observers saw a bullish signal pop up on other markets which could indicate cross-asset fund flows as traders rotate into risk assets. Bitcoin price has gone parabolic in recent weeks, and while the leading cryptocurrency by The figures also explained that there was a low volume on cryptocurrency exchanges than there was on forex and stock exchanges. The so-called Golden Cross was triggered for the first time since , as Reuters noted, fueling bullish price action in U. Safekeeping will be supported by insurance, cybersecurity, and comprehensive compliance, including an anti-money-laundering program and blockchain analytics. April 2, , 3: The rally has also seen the return of noted pseudonymous cryptocurrency traders like Parabolic Trav after a many-month hiatus, which many market participants view as a signal that we may have seen the worst of crypto winter.

Dips Remain Attractive To Buyers. Furthermore, trading volumes over the past month have been steadily picking up, providing a much-needed sigh of relief to cryptocurrency exchanges. Binance, for instance, featured coins on its platform, while its commission rate was 0. Davit Babayan 2 months ago. Zhao did warn, however, that the crypto winter would likely drag on throughoutwith the bulls not returning to the market until can cloud mining be profitable cloud mining calculator As the founding editor of Verdict. Comparing with Oanda, Gemini was times more expensive. Bitmex, on the other hand, came to be six times more expensive based on the same Oanda metrics. I accept I decline. Tony Spilotro 2 hours ago. Billy Bambrough Contributor. Close Menu Search Search. All Cryptocurrency bank account top altcoin returns Reserved. The Latest. Be among the first to get important crypto and blockchain news and information with Forbes Crypto Confidential. At the same time, their traditional peers were hosting trillions of dollars of volume every day.

Twitter Facebook LinkedIn Link. Remarking that a trader at Oanda would pay a 0. Privacy Center Cookie Policy. Read More. The cryptocurrency analyst broke down the fee structure of some of the most popular crypto spot trading platforms. Cole Petersen 4 hours ago. At the same time, the market observers saw a bullish signal pop up on other markets which could indicate cross-asset fund flows as traders rotate into risk assets. Binance, for instance, featured coins on its platform, while its commission rate was 0. March 28th, by Davit Babayan. Grainger, a veteran broker, told Business Insider. Dorsey last week reiterated his expectation that bitcoin would eventually become the internets first "native currency. I occasionally hold some small amount of bitcoin and other cryptocurrencies. Deutsche Bank. Join The Block Genesis Now. Load More. He added that commissions went as high as thousands of dollars depending on the size of the position. Crypto exchanges, being working in a nascent market, had lower volumes than their traditional counterparts. Trading May 13, Daily Hodl Staff. Email address: Crypto fees are generally high even after adjusting by relative volatility. The big move took place overnight, gapping up in a market with thin liquidity where shorts were liquidated and various brokers were hedged on short gamma positions. Looking at technicals, we saw bitcoin last night break its daily moving average, a technical indicator that shows a particular asset is on a bullish trajectory. The short-term market rally was precipitated by large moves up in other high-beta assets such as LTC and BNB which made local and all-time highs in recent months. Gemini, on the other hand, listed only five cryptocurrencies and charged a maker and taker fee of 2-percent, as mentioned above. As Bakkt pursues its goal of operating as a qualified custodian for digital assets, rival ErisX has also announced plans to launch later this year. Bitcoin Crypto Industry 3 mins. The bitcoin price slid steadily throughout following its epic bull run the year before. Both companies intend to help bring cryptocurrencies to the mainstream by collaborating with regulators. That was percent more than Coinbase and percent higher than what Kraken cost its customers.

Bitmex, on the other hand, came to be six times more expensive based on the same Oanda metrics. Twitter Facebook LinkedIn Link. Twitter Facebook LinkedIn Link trading algos. Cameron Winklevoss, early Bitcoin investor the outspoken co-founder of the Gemini crypto Gemini, on the other hand, listed only five cryptocurrencies and charged a maker and taker fee of 2-percent, as mentioned. That was percent more than Coinbase and percent higher than what Kraken cost its customers. The bitcoin price jumped last week but has failed to break out of its downward trend so far in And the market for initial coin offerings essentially vanished. He compared the commissions charged for the lowest volume trades with those imposed by traditional brokers and exchanges, finding that at an average of a 0. Safekeeping will be supported by insurance, cybersecurity, and comprehensive compliance, including an anti-money-laundering program and blockchain analytics. Be among the first to get important crypto and blockchain news and information with Forbes Crypto Confidential. At the same time, the market observers saw a bullish signal pop up on other markets which could indicate cross-asset fund flows as traders rotate into risk assets. Bitcoin Crypto Industry 3 mins. China has become an important country for bitcoin and cryptocurrency in recent yearswith some expressing concern that China's bitcoin mining dominance gives it too much control over the burgeoning digital token. In an effort to satisfy the concerns of the CFTC, the new filings for the physically-settled Bitcoin futures contracts detail a number of procedures related to security. The figures also explained that there was a low volume on cryptocurrency exchanges than there was on what is bitcoin going to be worth in 2019 stack exchange bitcoin and stock exchanges. Coinbase Pro, with its 16 coins, take a 0. Cryptocurrency exchanges trading a higher number of coins than their bitcoin bip bitcoin shorts analysis had cheaper fee structures. A Bitcoin covenant proposal View Article. Grainger, a veteran broker, told Business Insider. Comparing with Oanda, Gemini was times more expensive. Both companies intend to help bring cryptocurrencies to the mainstream by estimate hashrate of computer hardware eterium mining pool with regulators. Looking at technicals, we saw bitcoin last night break its daily moving average, a technical indicator that shows a particular asset is on a bullish trajectory. Last year was complicated for digital how to transfer steem from bittrex to steemit aurora coinbase. Dips Remain Attractive To Buyers. Dorsey last week reiterated his expectation that bitcoin would eventually become the internets first "native currency. Email address: I occasionally hold some small amount of bitcoin and other cryptocurrencies. More scalability could have allowed the established corporations to lower their fees. The company says it is working closely with the Commodity Futures Trading Commission CFTC to bring its new products — daily and monthly Bitcoin futures contracts — to market, following several delays that have stalled the project since its initial target date of December 12,

Bitmex, on the other hand, came to be six times more expensive based on the same Oanda metrics. Twitter Facebook LinkedIn Link. Twitter Facebook LinkedIn Link trading algos. Cameron Winklevoss, early Bitcoin investor the outspoken co-founder of the Gemini crypto Gemini, on the other hand, listed only five cryptocurrencies and charged a maker and taker fee of 2-percent, as mentioned. That was percent more than Coinbase and percent higher than what Kraken cost its customers. The bitcoin price jumped last week but has failed to break out of its downward trend so far in And the market for initial coin offerings essentially vanished. He compared the commissions charged for the lowest volume trades with those imposed by traditional brokers and exchanges, finding that at an average of a 0. Safekeeping will be supported by insurance, cybersecurity, and comprehensive compliance, including an anti-money-laundering program and blockchain analytics. Be among the first to get important crypto and blockchain news and information with Forbes Crypto Confidential. At the same time, the market observers saw a bullish signal pop up on other markets which could indicate cross-asset fund flows as traders rotate into risk assets. Bitcoin Crypto Industry 3 mins. China has become an important country for bitcoin and cryptocurrency in recent yearswith some expressing concern that China's bitcoin mining dominance gives it too much control over the burgeoning digital token. In an effort to satisfy the concerns of the CFTC, the new filings for the physically-settled Bitcoin futures contracts detail a number of procedures related to security. The figures also explained that there was a low volume on cryptocurrency exchanges than there was on what is bitcoin going to be worth in 2019 stack exchange bitcoin and stock exchanges. Coinbase Pro, with its 16 coins, take a 0. Cryptocurrency exchanges trading a higher number of coins than their bitcoin bip bitcoin shorts analysis had cheaper fee structures. A Bitcoin covenant proposal View Article. Grainger, a veteran broker, told Business Insider. Comparing with Oanda, Gemini was times more expensive. Both companies intend to help bring cryptocurrencies to the mainstream by estimate hashrate of computer hardware eterium mining pool with regulators. Looking at technicals, we saw bitcoin last night break its daily moving average, a technical indicator that shows a particular asset is on a bullish trajectory. Last year was complicated for digital how to transfer steem from bittrex to steemit aurora coinbase. Dips Remain Attractive To Buyers. Dorsey last week reiterated his expectation that bitcoin would eventually become the internets first "native currency. Email address: I occasionally hold some small amount of bitcoin and other cryptocurrencies. More scalability could have allowed the established corporations to lower their fees. The company says it is working closely with the Commodity Futures Trading Commission CFTC to bring its new products — daily and monthly Bitcoin futures contracts — to market, following several delays that have stalled the project since its initial target date of December 12,

Twitter Facebook LinkedIn Link trading algos. Safekeeping will be supported by insurance, cybersecurity, and comprehensive compliance, including an anti-money-laundering program and blockchain analytics. The company says it is working closely how much bitcoin worth today bitcoin related companies the Commodity Futures Trading Commission CFTC to bring its new products — daily and monthly Bitcoin futures contracts — to market, following several delays that have ethereum algo how to move gemini to coinbase the project since its initial target date of December 12, Email address: I think it will be [bitcoin] given all the tests it has been through and the principles behind it, how it was created," Dorsey told podcaster Joe Rogan, though he didn't speculate on what this might do to the bitcoin price. I occasionally hold some small amount of bitcoin and other cryptocurrencies. Remarking that a trader at Oanda would pay a 0. Bitcoin has once again incurred a sudden influx of buying pressure that has allowed it to Looking at technicals, we saw bitcoin last night like hashing24 liquid cooled mining rig its daily moving average, a technical indicator that shows a particular asset is on a bullish trajectory. All Rights Reserved. The Latest. A Bitcoin covenant proposal View Article. We use cookies to give you the best online experience possible. Comparing with Oanda, Gemini was times more expensive. Crypto fees are generally high even after adjusting by relative volatility. Grainger, a veteran broker, told Business Insider. That was percent more than Coinbase and percent higher than what Kraken cost its customers. I am a journalist with significant experience covering technology, finance, economics, and business around the world. As the founding editor of Verdict.

The company says it is working closely with the Commodity Futures Trading Commission CFTC to bring its new products — daily and monthly Bitcoin futures contracts — to market, following several delays that have stalled the project since its initial target date of December 12, That was percent more than Coinbase and percent higher than what Kraken cost its customers. Coinbase Pro, with its 16 coins, take a 0. Crypto exchanges, being working in a nascent market, had lower volumes than their traditional counterparts. The Latest. Crypto fees are generally high even after adjusting by relative volatility. Remarking that a trader at Oanda would pay a 0. Dips Remain Attractive To Buyers. Cole Petersen 4 hours ago. Looking at technicals, we saw bitcoin last night break its daily moving average, a technical indicator that shows a particular asset is on a bullish trajectory. China has become an important country for bitcoin and cryptocurrency in recent years , with some expressing concern that China's bitcoin mining dominance gives it too much control over the burgeoning digital token. Still, momentum in the market has shifted as of late with a number of initial exchange offerings, token raises sponsored by crypto exchanges, taking the market by storm. As the founding editor of Verdict. Comparing with Oanda, Gemini was times more expensive. Close Menu Sign up for our newsletter to start getting your news fix. Last year was complicated for digital assets. By agreeing you accept the use of cookies in accordance with our cookie policy. I occasionally hold some small amount of bitcoin and other cryptocurrencies. Sign up for free now. Cameron Winklevoss, early Bitcoin investor the outspoken co-founder of the Gemini crypto Such efforts are expected to bring in the next wave of crypto-related services and institutional investors. Bitcoin Crypto Industry 3 mins. At the same time, the market observers saw a bullish signal pop up on other markets which could indicate cross-asset fund flows as traders rotate into risk assets. Bitcoin price has gone parabolic in recent weeks, and while the leading cryptocurrency by The figures also explained that there was a low volume on cryptocurrency exchanges than there was on forex and stock exchanges. The so-called Golden Cross was triggered for the first time since , as Reuters noted, fueling bullish price action in U. Safekeeping will be supported by insurance, cybersecurity, and comprehensive compliance, including an anti-money-laundering program and blockchain analytics. April 2, , 3: The rally has also seen the return of noted pseudonymous cryptocurrency traders like Parabolic Trav after a many-month hiatus, which many market participants view as a signal that we may have seen the worst of crypto winter.

Dips Remain Attractive To Buyers. Furthermore, trading volumes over the past month have been steadily picking up, providing a much-needed sigh of relief to cryptocurrency exchanges. Binance, for instance, featured coins on its platform, while its commission rate was 0. Davit Babayan 2 months ago. Zhao did warn, however, that the crypto winter would likely drag on throughoutwith the bulls not returning to the market until can cloud mining be profitable cloud mining calculator As the founding editor of Verdict. Comparing with Oanda, Gemini was times more expensive. Bitmex, on the other hand, came to be six times more expensive based on the same Oanda metrics. I accept I decline. Tony Spilotro 2 hours ago. Billy Bambrough Contributor. Close Menu Search Search. All Cryptocurrency bank account top altcoin returns Reserved. The Latest. Be among the first to get important crypto and blockchain news and information with Forbes Crypto Confidential. At the same time, their traditional peers were hosting trillions of dollars of volume every day.

Twitter Facebook LinkedIn Link. Remarking that a trader at Oanda would pay a 0. Privacy Center Cookie Policy. Read More. The cryptocurrency analyst broke down the fee structure of some of the most popular crypto spot trading platforms. Cole Petersen 4 hours ago. At the same time, the market observers saw a bullish signal pop up on other markets which could indicate cross-asset fund flows as traders rotate into risk assets. Binance, for instance, featured coins on its platform, while its commission rate was 0. March 28th, by Davit Babayan. Grainger, a veteran broker, told Business Insider. Dorsey last week reiterated his expectation that bitcoin would eventually become the internets first "native currency. I occasionally hold some small amount of bitcoin and other cryptocurrencies. Deutsche Bank. Join The Block Genesis Now. Load More. He added that commissions went as high as thousands of dollars depending on the size of the position. Crypto exchanges, being working in a nascent market, had lower volumes than their traditional counterparts. Trading May 13, Daily Hodl Staff. Email address: Crypto fees are generally high even after adjusting by relative volatility. The big move took place overnight, gapping up in a market with thin liquidity where shorts were liquidated and various brokers were hedged on short gamma positions. Looking at technicals, we saw bitcoin last night break its daily moving average, a technical indicator that shows a particular asset is on a bullish trajectory. The short-term market rally was precipitated by large moves up in other high-beta assets such as LTC and BNB which made local and all-time highs in recent months. Gemini, on the other hand, listed only five cryptocurrencies and charged a maker and taker fee of 2-percent, as mentioned above. As Bakkt pursues its goal of operating as a qualified custodian for digital assets, rival ErisX has also announced plans to launch later this year. Bitcoin Crypto Industry 3 mins. The bitcoin price slid steadily throughout following its epic bull run the year before. Both companies intend to help bring cryptocurrencies to the mainstream by collaborating with regulators. That was percent more than Coinbase and percent higher than what Kraken cost its customers.

Twitter Facebook LinkedIn Link trading algos. Safekeeping will be supported by insurance, cybersecurity, and comprehensive compliance, including an anti-money-laundering program and blockchain analytics. The company says it is working closely how much bitcoin worth today bitcoin related companies the Commodity Futures Trading Commission CFTC to bring its new products — daily and monthly Bitcoin futures contracts — to market, following several delays that have ethereum algo how to move gemini to coinbase the project since its initial target date of December 12, Email address: I think it will be [bitcoin] given all the tests it has been through and the principles behind it, how it was created," Dorsey told podcaster Joe Rogan, though he didn't speculate on what this might do to the bitcoin price. I occasionally hold some small amount of bitcoin and other cryptocurrencies. Remarking that a trader at Oanda would pay a 0. Bitcoin has once again incurred a sudden influx of buying pressure that has allowed it to Looking at technicals, we saw bitcoin last night like hashing24 liquid cooled mining rig its daily moving average, a technical indicator that shows a particular asset is on a bullish trajectory. All Rights Reserved. The Latest. A Bitcoin covenant proposal View Article. We use cookies to give you the best online experience possible. Comparing with Oanda, Gemini was times more expensive. Crypto fees are generally high even after adjusting by relative volatility. Grainger, a veteran broker, told Business Insider. That was percent more than Coinbase and percent higher than what Kraken cost its customers. I am a journalist with significant experience covering technology, finance, economics, and business around the world. As the founding editor of Verdict.

The company says it is working closely with the Commodity Futures Trading Commission CFTC to bring its new products — daily and monthly Bitcoin futures contracts — to market, following several delays that have stalled the project since its initial target date of December 12, That was percent more than Coinbase and percent higher than what Kraken cost its customers. Coinbase Pro, with its 16 coins, take a 0. Crypto exchanges, being working in a nascent market, had lower volumes than their traditional counterparts. The Latest. Crypto fees are generally high even after adjusting by relative volatility. Remarking that a trader at Oanda would pay a 0. Dips Remain Attractive To Buyers. Cole Petersen 4 hours ago. Looking at technicals, we saw bitcoin last night break its daily moving average, a technical indicator that shows a particular asset is on a bullish trajectory. China has become an important country for bitcoin and cryptocurrency in recent years , with some expressing concern that China's bitcoin mining dominance gives it too much control over the burgeoning digital token. Still, momentum in the market has shifted as of late with a number of initial exchange offerings, token raises sponsored by crypto exchanges, taking the market by storm. As the founding editor of Verdict. Comparing with Oanda, Gemini was times more expensive. Close Menu Sign up for our newsletter to start getting your news fix. Last year was complicated for digital assets. By agreeing you accept the use of cookies in accordance with our cookie policy. I occasionally hold some small amount of bitcoin and other cryptocurrencies. Sign up for free now. Cameron Winklevoss, early Bitcoin investor the outspoken co-founder of the Gemini crypto Such efforts are expected to bring in the next wave of crypto-related services and institutional investors. Bitcoin Crypto Industry 3 mins. At the same time, the market observers saw a bullish signal pop up on other markets which could indicate cross-asset fund flows as traders rotate into risk assets. Bitcoin price has gone parabolic in recent weeks, and while the leading cryptocurrency by The figures also explained that there was a low volume on cryptocurrency exchanges than there was on forex and stock exchanges. The so-called Golden Cross was triggered for the first time since , as Reuters noted, fueling bullish price action in U. Safekeeping will be supported by insurance, cybersecurity, and comprehensive compliance, including an anti-money-laundering program and blockchain analytics. April 2, , 3: The rally has also seen the return of noted pseudonymous cryptocurrency traders like Parabolic Trav after a many-month hiatus, which many market participants view as a signal that we may have seen the worst of crypto winter.

Dips Remain Attractive To Buyers. Furthermore, trading volumes over the past month have been steadily picking up, providing a much-needed sigh of relief to cryptocurrency exchanges. Binance, for instance, featured coins on its platform, while its commission rate was 0. Davit Babayan 2 months ago. Zhao did warn, however, that the crypto winter would likely drag on throughoutwith the bulls not returning to the market until can cloud mining be profitable cloud mining calculator As the founding editor of Verdict. Comparing with Oanda, Gemini was times more expensive. Bitmex, on the other hand, came to be six times more expensive based on the same Oanda metrics. I accept I decline. Tony Spilotro 2 hours ago. Billy Bambrough Contributor. Close Menu Search Search. All Cryptocurrency bank account top altcoin returns Reserved. The Latest. Be among the first to get important crypto and blockchain news and information with Forbes Crypto Confidential. At the same time, their traditional peers were hosting trillions of dollars of volume every day.

Twitter Facebook LinkedIn Link. Remarking that a trader at Oanda would pay a 0. Privacy Center Cookie Policy. Read More. The cryptocurrency analyst broke down the fee structure of some of the most popular crypto spot trading platforms. Cole Petersen 4 hours ago. At the same time, the market observers saw a bullish signal pop up on other markets which could indicate cross-asset fund flows as traders rotate into risk assets. Binance, for instance, featured coins on its platform, while its commission rate was 0. March 28th, by Davit Babayan. Grainger, a veteran broker, told Business Insider. Dorsey last week reiterated his expectation that bitcoin would eventually become the internets first "native currency. I occasionally hold some small amount of bitcoin and other cryptocurrencies. Deutsche Bank. Join The Block Genesis Now. Load More. He added that commissions went as high as thousands of dollars depending on the size of the position. Crypto exchanges, being working in a nascent market, had lower volumes than their traditional counterparts. Trading May 13, Daily Hodl Staff. Email address: Crypto fees are generally high even after adjusting by relative volatility. The big move took place overnight, gapping up in a market with thin liquidity where shorts were liquidated and various brokers were hedged on short gamma positions. Looking at technicals, we saw bitcoin last night break its daily moving average, a technical indicator that shows a particular asset is on a bullish trajectory. The short-term market rally was precipitated by large moves up in other high-beta assets such as LTC and BNB which made local and all-time highs in recent months. Gemini, on the other hand, listed only five cryptocurrencies and charged a maker and taker fee of 2-percent, as mentioned above. As Bakkt pursues its goal of operating as a qualified custodian for digital assets, rival ErisX has also announced plans to launch later this year. Bitcoin Crypto Industry 3 mins. The bitcoin price slid steadily throughout following its epic bull run the year before. Both companies intend to help bring cryptocurrencies to the mainstream by collaborating with regulators. That was percent more than Coinbase and percent higher than what Kraken cost its customers.